Filed Pursuant to Rule 424(b)(4)

Registration No. 333-114568

PROSPECTUS

3,205,367 SHARES

PURE CYCLE CORPORATION

COMMON STOCK, $.00333 par value

The 3,205,367 shares of common stock, $.00333 par value, offered hereby are being offered by Pure Cycle Corporation and by certain Pure Cycle stockholders. Of the total number of shares offered, 700,000 shares are being offered by Pure Cycle and 2,505,367 shares are being offered by the selling stockholders. See "Selling Stockholders."

Pure Cycle's common stock is quoted on the OTC Bulletin Board under the symbol "PCYO." On June 18, 2004, the last reported sales price of our common stock on the OTC Bulletin Board was $9.50 per share. We have applied for listing of our common stock on the NASDAQ SmallCap under the symbol "PCYO."

For a discussion of certain risks that should be considered by prospective investors, see "Risk Factors" beginning on page 7 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| |

Per Share |

Total |

||||

|---|---|---|---|---|---|---|

| Offering price | $ | 9.00000 | $ | 28,848,303 | ||

| Underwriting discount | $ | 0.59625 | $ | 1,911,200 | ||

| Proceeds, before expenses, to Pure Cycle | $ | 8.40375 | $ | 5,882,625 | ||

| Proceeds, before expenses, to selling stockholders | $ | 8.40375 | $ | 21,054,478 | ||

We have granted an over-allotment option to the underwriter. Under this option, the underwriter may elect to purchase a maximum of 480,805 additional shares from us within 30 days following the date of this prospectus to cover over-allotments. See "Plan of Distribution."

FLAGSTONE SECURITIES

The date of this prospectus is June 21, 2004.

SPECIAL SUITABILITY FOR CALIFORNIA RESIDENTS

Persons resident in California, other than persons exempt under Section 25102(i) of the Corporate Securities Law of the state of California, who wish to purchase shares of our common stock must:

| |

Page |

|

|---|---|---|

| PROSPECTUS SUMMARY | 1 | |

| RISK FACTORS | 7 | |

| FORWARD-LOOKING STATEMENTS | 15 | |

| USE OF PROCEEDS | 16 | |

| CAPITALIZATION | 17 | |

| MARKET PRICE OF AND DIVIDENDS FOR OUR COMMON EQUITY AND RELATED STOCKHOLDER MATTERS | 18 | |

| SELECTED FINANCIAL DATA | 19 | |

| MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 20 | |

| BUSINESS | 29 | |

| PROPERTIES | 41 | |

| MANAGEMENT | 41 | |

| COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS | 43 | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERSHIP AND MANAGEMENT | 44 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 46 | |

| DESCRIPTION OF SECURITIES | 47 | |

| SELLING STOCKHOLDERS | 52 | |

| PLAN OF DISTRIBUTION | 53 | |

| LEGAL MATTERS | 55 | |

| EXPERTS | 55 | |

| WHERE YOU CAN FIND MORE INFORMATION | 56 |

As used in this prospectus, the terms "Pure Cycle," the "Company," "we," "our," or "us" refer to Pure Cycle Corporation, unless the context otherwise indicates.

Unless otherwise stated, all information in this prospectus gives effect to the 1-for-10 reverse stock split of our common stock that was effective on April 26, 2004.

Unless otherwise stated in this prospectus, all information contained in this prospectus assumes no exercise of the over-allotment option granted to the underwriter.

The underwriter is offering the shares subject to various conditions and may reject all or part of any order. The common stock should be ready for delivery on or about June 24, 2004 against payment in immediately available funds.

i

This summary highlights information contained elsewhere in this prospectus. Because it is a summary, it does not contain all of the information that you should consider before investing in our common stock. You should read the entire prospectus carefully.

We own or have rights to use significant water assets which we have begun to utilize to provide water and wastewater services to customers located in the Denver, Colorado metropolitan area near our principal water assets. We will operate water and wastewater systems to deliver and treat the water we provide. Our services will include designing, constructing, operating and maintaining systems to service our customers.

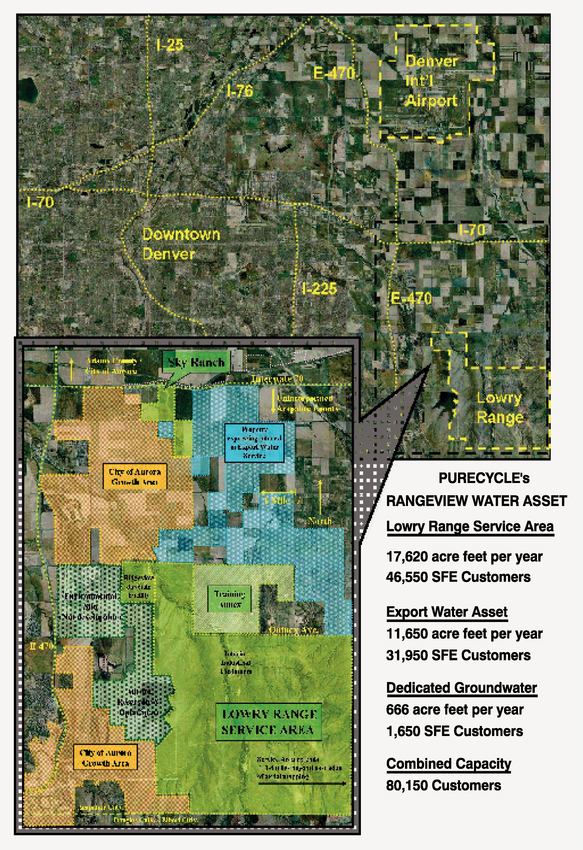

Rangeview Water Assets.

We have exclusive access to approximately 29,000 acre feet per year of water from, and the exclusive right to provide water and wastewater services to, 24,000 acres of primarily undeveloped land in eastern Colorado known as the Lowry Range (the "Lowry Range service area"). The Lowry Range is located in Arapahoe County approximately 15 miles southeast of Denver and 12 miles south of the Denver International Airport. Of the approximately 29,000 acre feet of water to which we have access annually, 17,500 acre feet are available to us for use on the Lowry Range. We own the remaining 11,650 acre feet and we can "export" it from the Lowry Range to supply water to nearby communities and developers in need of additional water supplies ("Export Water"). If we do not use our full annual entitlement in any year, we are permitted to increase our utilization in a subsequent year to the extent of the deficit, but the aggregate amount to be withdrawn cannot exceed 1,165,000 area feet for customers located off the Lowry Range. We acquired these rights and the Export Water in 1996 when we entered into an 85-year agreement with the State of Colorado Board of Land Commissioners ("State Land Board"), which owns the Lowry Range, and the Rangeview Metropolitan District (the "District"), a quasi-municipal political subdivision formed for the sole purpose of providing water and wastewater services to the Lowry Range. We refer to all of these assets as our Rangeview water supply.

We are in the early stages of utilizing our Rangeview water assets. Since June 2001, we have been supplying water and wastewater services in the Lowry Range service area to approximately 200 single family equivalent, or SFE, units through service to the Ridge View Youth Services Center, a 500 bed juvenile facility. In October 2003, we entered into a contract to provide water service to Sky Ranch, a proposed mixed-use development of single and multi-family residences and commercial space. Sky Ranch will be located approximately four miles north of the Lowry Range along Interstate-70 in Arapahoe County. When the development is complete, we expect to supply Sky Ranch with water services for 4,000 SFE units. Our agreement does not call for us to provide wastewater services to Sky Ranch. In May 2004, we entered into a second agreement with the developer of Sky Ranch to provide water services to an additional 850 SFEs at Hills at Sky Ranch, a development adjacent to, and to be developed concurrently with, Sky Ranch. These two contracts are referred to herein as the "Sky Ranch Agreements." We expect the initial site development of both Sky Ranch and Hills at Sky Ranch to begin in the fall of 2004, with housing construction to begin in the spring of 2005. While we are currently actively marketing our water services to other developers and property owners in areas near the Sky Ranch development, the Ridge View Youth Services Center represents our only current operation.

Operations. We will have two sources of revenue from providing water and water services. We will receive a one time "tap" fee, generally paid by the developer, and annual service and use charges based on the monthly metered water deliveries to the water user. The water tap fee has two components: a system development fee, which gives the customer access to the water system and is used for

1

construction of the water delivery system, and a water resource fee, which defrays the costs of acquiring the water rights. Under the terms of our agreement with the State Land Board, our tap fees and use charges may not exceed the average of the tap fees and use charges of three nearby communities. This average, which is adjusted annually, has risen by approximately 52% since 2000 and is presently $12,420 per SFE. Generally, we receive 95% of these tap fees after deducting a 12% royalty payable to the State Land Board, which royalty will be subject to increase in certain circumstances. In exchange for developing, operating and maintaining the wastewater system, we receive 100% of wastewater tap fees, presently $4,883 per SFE, and 90% of monthly wastewater usage fees. We also receive wastewater service fees. Annual water service fees per SFE are approximately $578 and annual wastewater service fees per SFE are approximately $404.

We expect to utilize the portion of the tap fees designated by the District as the system development portion to construct the infrastructure necessary to deliver water. We expect ongoing water and wastewater usage fees to cover costs of operating the water and wastewater systems. We will design the water and wastewater delivery systems and contract with third parties for construction of the systems. We plan to utilize a dual distribution system that contains two water pipes, one for potable water that will go directly to a residence and a second for non-potable water that will be used to deliver water for outdoor irrigation use. A third pipe will return the wastewater to our treatment facility where it will be processed to Colorado Department of Public Health and Environment ("CDPHE") standards for irrigation water and then, subject to approval by the CDPHE, returned through the second delivery pipe for outdoor non-potable use.

Under the terms of financing agreements we entered into in connection with the acquisition of our Rangeview water assets, we are obligated to pay the first $36,240,000 of proceeds (after royalty payments) from the sale of Export Water to parties to these agreements. We will make these payments from the water resource portion of the tap fees we receive on the sale of Export Water. These financing agreements will not restrict our use of the system development portion of the tap fees to finance construction of the water and wastewater delivery systems.

Opportunity. The Denver Regional Council of Governments has estimated that between 2000 and 2025 the population in the Denver metropolitan area will increase from 2.4 million to 3.4 million. An independent consultant to the State Land Board and the District has forecast that approximately 50% of new land development in metropolitan Denver will occur in the area south of Interstate-70 and east of Interstate-25, an area of Arapahoe County that includes the Lowry Range, Sky Ranch and surrounding areas. Because of ongoing water shortages, any developer submitting a land use plan to Arapahoe County is required to provide assurance that water will be available to service the development prior to any consideration of a change in land use.

The State Land Board is in the initial stages of developing a plan to solicit requests for proposals (RFPs) to engage a development partner to assist the State Land Board in planning for future development of the Lowry Range. If RFPs are sent as planned later this summer, we expect that the first stage of the long-term development of the Lowry Range could start within three years. We estimate that full development of the Lowry Range will take in excess of 30 years.

We have received confirmation from independent engineering firms that our Rangeview water assets are capable of providing water service to approximately 80,000 SFE units. Our Rangeview water assets have been adjudicated in the Colorado water courts in decrees specifying the amount of water we own or have a right to use and that the water is available for municipal use. We believe, based on these Water Court decrees and the location of our water on or near areas of projected future development, that we have significant opportunities to utilize our water resources.

2

Paradise Water Supply.

We own conditional water rights in western Colorado that entitle us to build a 70,000 acre foot reservoir to store tributary water on the Colorado River. We will seek to develop and market this water either to the greater Denver metropolitan area or in markets in the downstream states of Nevada, Arizona and California. Our ability to use this asset may be limited, however, because of constraints imposed by the difficulties and costs involved in transporting the water out of the Colorado River watershed to the Denver metropolitan area and because of legal complications in transferring such water to downstream states under the interstate Colorado River Compact.

General.

We were incorporated in Delaware in 1976. Our corporate offices are located at 8451 Delaware Street, Thornton, Colorado 80260. Our telephone number is (303) 292-3456.

3

| Common stock offered by Pure Cycle | 700,000 shares | |

Common stock offered by selling stockholders |

2,505,367 shares |

|

Common stock outstanding before the offering |

10,374,954 shares |

|

Common stock to be outstanding after the offering |

11,074,954 shares |

|

Use of proceeds of common stock sold by Pure Cycle |

To pay outstanding indebtedness, for water system expenditures, and for working capital and other general corporate purposes, including acquisitions and to buy out third party rights to receive proceeds from the sale of Export Water, to the extent such rights are available on acceptable terms. |

|

OTC Bulletin Board and symbol |

PCYO |

|

Proposed NASDAQ SmallCap symbol |

PCYO |

The shares of common stock outstanding before the offering is based on the number of shares of common stock outstanding at February 29, 2004, increased by:

and excludes:

The common stock offered by selling stockholders in this offering consists of the Selling Stockholder Option and Warrant Shares and 1,121,000 shares of common stock that are currently owned by selling stockholders (collectively, the "Selling Stockholder Shares").

At February 29, 2004, the Selling Stockholder Option and Warrant Shares were not outstanding, but these options and warrants will be exercised immediately prior to the sale of the shares in this offering. If all of these options and warrants are exercised, we will receive $2,491,860 of gross proceeds.

4

The $856,060 exercise price for the options will be paid in cash and the exercise price for the warrants will be paid $3,026 in cash and $1,632,774 in the form of 4% promissory notes payable to Pure Cycle, secured by the stock issued upon exercise. The notes are required to be paid with the proceeds of the sale of the stock in this offering. If the warrant holders' shares are not sold, we expect that we will foreclose on the promissory notes and cancel the shares.

The information in this prospectus, other than the financial statements and Management's Discussion and Analysis of Financial Condition and Results of Operations, assumes that these options and warrants have been exercised, the Series D and Series D-1 preferred stock have been converted, the common stock issued or issuable on exercise and conversion are outstanding, and the promissory notes payable to Pure Cycle in partial consideration of the exercise price for the warrants have been repaid.

5

The following table shows selected summary financial data for Pure Cycle as of the dates and for the periods indicated. You should read this data in conjunction with the financial statements and notes included in this prospectus beginning on page F-1.

| |

Six Months Ended |

Year Ended |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Feb. 29, 2004 |

Feb. 28, 2003 |

August 31, 2003 |

August 31, 2002 |

||||||||||

| |

(Unaudited) |

|

|

|||||||||||

| Statement of Operations | ||||||||||||||

| Revenues | $ | 85,731 | $ | 103,812 | $ | 225,432 | $ | 204,858 | ||||||

| Expenses: | ||||||||||||||

| Operating | 11,338 | 10,732 | 37,496 | 27,792 | ||||||||||

| General and administrative | 219,302 | 124,556 | 318,182 | 221,872 | ||||||||||

| Operating loss | (147,691 | ) | (34,784 | ) | (135,841 | ) | (49,764 | ) | ||||||

| Other expense, net | 91,259 | 92,572 | 185,212 | 195,383 | ||||||||||

Net loss |

(238,950 |

) |

(127,356 |

) |

(321,043 |

) |

(245,147 |

) |

||||||

Basic and diluted net loss per common share |

$ |

(0.03 |

) |

$ |

(0.02 |

) |

$ |

(0.04 |

) |

$ |

(0.03 |

) |

||

Weighted average number of shares of common stock outstanding—basic and diluted |

8,056,418 |

7,843,976 |

7,843,976 |

7,843,976 |

||||||||||

| |

February 29, 2004 |

|||||

|---|---|---|---|---|---|---|

| |

Actual |

As Adjusted(1) |

||||

| |

(Unaudited) |

|||||

| Balance Sheet Data: | ||||||

| Cash and cash equivalents | $ | 338,559 | $ | 6,189,023 | ||

| Investment in water and systems | 19,410,635 | 19,410,635 | ||||

| Total assets | 20,254,298 | 27,304,762 | ||||

| Working capital | 327,790 | 6,178,254 | ||||

| Long-term debt-related parties, including accrued interest | 4,976,511 | 3,867,450 | ||||

| Participating interests in Rangeview water supply | 11,090,630 | 11,090,630 | ||||

| Stockholders' equity | 4,142,507 | 12,301,998 | ||||

6

Investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors, in addition to the other information in this prospectus, before investing in our common stock.

We are dependent for future revenues on development of the Lowry Range and of the other areas near our Rangeview water assets that are potential markets for our Export Water.

We expect that our principal source of future revenue will be from two contracts that entitle us to provide water and wastewater service in the Lowry Range service area. The timing and amount of these revenues will depend significantly on the development of this area. The land in the Lowry Range is owned by the State Land Board, which is in the early stages of considering various development alternatives, but no timetable exists for development. We are not able to determine the timing of water sales or the timing of development. There can be no assurance that development will occur, or that water sales will occur on acceptable terms or in the amounts or time required for us to support our costs of operation. Because of the prior use of the Lowry Range as a military reservation, environmental clean-up may be required prior to development, including to remove unexploded ordnance. There is often significant delay in adoption of development plans, as the political process involves many constituencies with differing interests. In the event water sales are not forthcoming or development of the Lowry Range is delayed, we may incur additional short or long-term debt obligations or seek to sell additional equity to generate operating capital. These sales of equity may be at prices that are dilutive to existing investors.

Our operations are significantly affected by the general economic conditions for real estate development and the pace and location of real estate development activities in the greater Denver metropolitan area, most particularly areas such as Sky Ranch which are near to our Rangeview water assets and thus are potential markets for our Export Water. Increases in the number of our water and wastewater connections, our connection fees and our billings and collections will depend on real estate development in this area. We have no ability to control the pace and location of real estate development activities which affect our business.

We are a start-up business and do not have significant experience in the large-scale sale of water and operation of water and wastewater systems.

Although we have been in operation since 1976, our expected future operations are significantly different from the businesses in which we have been engaged over most of our past. While we have constructed and are operating one water and wastewater treatment facility on the Lowry Range, that facility serves only one customer and provides revenues of only about $15,000 per month, representing 81% of our total revenues. We do not yet have significant experience in the large-scale sale of water and operation of water and wastewater systems and our revenue growth will depend on our ability to enter into new operating contracts with municipal water districts and developers. Because we have not built a large number of water and wastewater systems, we cannot assure you that the portion of the tap fee revenue that we will utilize for construction of our water delivery system will cover the costs of construction, particularly since a disproportionately greater cost must be paid in the initial stage of construction, and the tap fees are assessed equally at all stages of a development. A significant portion of our marketing and sales effort is spent demonstrating to municipal water districts and developers our operating capabilities and the viability of our water assets, but our inability to point to a history of successful operations may be a competitive disadvantage in obtaining new contracts. In the Sky Ranch Agreements, the developer retained a right to terminate the agreements if it was unable to sell a specified number of lots to homebuilders within 24 months of receipt of required approvals due principally to the homebuilders' concerns over our ability to provide the required water. Our business is

7

subject to the risks often associated with start-up businesses, and you will be unable to evaluate our operations based on our past operating results.

Our net losses may continue and we may not have sufficient liquidity to pursue our business objectives.

We have experienced significant net losses and could continue to incur net losses. For the year ended August 31, 2003 and the six months ended February 29, 2004, we had net losses of $321,000 and $238,950, respectively, on revenues of $225,000 and $85,731 in the respective periods. Our cash flow from operations has been insufficient to fund our operations in the past, and we have been required to raise debt and equity capital from related parties to remain in operation. Since 1998, we have raised $1,310,000 through the issuance of 776,133 shares of common stock to support our operations. Our ability to fund our operational needs and meet our business objectives will depend on our ability to generate cash from future operations. If our future cash flow from operations and other capital resources are insufficient to fund our operations and the significant capital expenditure requirements to build our water delivery systems, we may be forced to reduce or delay our business activities, grant additional priority rights to revenues from the sale of Export Water, or seek to obtain additional debt or equity capital, which may not be available on acceptable terms, or at all.

Obligations under the Commercialization Agreement and other agreements will delay our ability to benefit from increased revenues.

We have entered into financing agreements with investors and in settlement of controversies over our Rangeview water assets that obligate us to pay to others the first $36,240,000 of certain revenues we receive from our sale of Export Water. Under the provisions of one of these financing agreements, called the Commercialization Agreement, we are required to pay to investors in the Rangeview project signatory to such agreement the first approximately $32,000,000 from the water resource component of the tap fees we receive from the sale or other disposition of Export Water. We are obligated to pay the next $4,000,000 of such revenues to another investor, and the next $433,000 in such revenues to the holders of our Series B Preferred Stock. These obligations, along with other indebtedness, pose risks to the holders of our common stock, including the risks that:

The rates we are allowed to charge customers are limited by the District's contract with the State Land Board and our contract with the District and may be insufficient to cover our costs of construction and operation.

The price we can charge for our water and wastewater services are subject to pricing regulations set in the District's contract with the State Land Board and our contract with the District. Both the tap fees and our usage rates and charges are based on the average of the rates of three surrounding quasi-governmental water providers. We survey annually the tap fees and rates and charges from the water providers that comprise our rate base group and set our tap fees and rates and charges based on the average of those charged by this group. Our costs associated with the construction of water delivery

8

systems and the production, treatment and delivery of our water are subject to market conditions and other factors, which may increase at a significantly greater rate than the prices charged by our rate base water providers. Factors beyond our control and which cannot be predicted, such as drought, water contamination and severe weather conditions, like tornadoes and floods, may result in additional labor and material costs that may not be recoverable under our operations and maintenance contracts, creating additional differences from the costs of our rate base water providers. Increased customer demand can also increase the overall cost of our operations. If the costs for construction and operation of our water services, including the cost of extracting our groundwater, exceed our revenues, we may petition the State Land Board for rate increases. We cannot assure that the State Land Board would grant us approval to increase rates beyond the average of the rate base water providers. Our profitability could be negatively impacted if we experience an imbalance of costs and revenues and are not successful in receiving approval for rate increases.

We are likely to be involved in on-going negotiations with the State Land Board to clarify our rights and obligations under contracts as they relate to specific transactions we enter into or to deal with additional opportunities, and we may be subject to adverse determinations if we are required to arbitrate these matters.

Our rights and obligations to our Rangeview water assets derive principally from an Amended and Restated Lease (the "Lease") between the State Land Board and Rangeview entered into in 1996 prior to any development of the Lowry Range or of areas outside the Lowry Range that utilize our Export Water. The terms of this agreement did not anticipate the specific circumstances of the development that have arisen and may not clearly delineate rights and responsibilities for the forms of transactions that may arise in the future as we enter into and negotiate agreements for sale of water. We anticipate that we will engage in negotiations with the State Land Board from time to time to clarify the applicability of contract terms to circumstances that were not anticipated at the time the agreements were entered into. Certain of these provisions may be material, and a determination, by an arbitrator or otherwise, of positions that are not favorable to us could have a material adverse effect on our financial results. In addition, we discuss periodically with the State Land Board opportunities for water utilization that were not available at the time of the Lease, which opportunities could be incorporated into the Lease. We cannot assure you that we will pursue additional opportunities or that such activities will be successful.

Our capital resources may restrict our ability to operate and expand our business.

As of February 29, 2004, we had cash and cash equivalents of $338,599. We have not been able to secure lines of credit to enable us to expand our operations. We may be unable to establish credit facilities or execute financing alternatives on terms that we find acceptable.

In order to obtain contracts, we must be able to demonstrate the ability to fund the significant investments required to build water delivery and treatment facilities. We may obtain funds for these obligations from the proceeds of this offering or the sale of stock and other equity related securities, our cash flow from operations, contributions by developers and the use of both short and long-term debt. If we are unable to establish lines of credit, or if we are unable to secure additional financing sources, our capital spending would be reduced or delayed, which would limit our growth.

We only have three employees and may not be able to manage the increasing demands of our expanding operations.

We expect that our activities relating to the Sky Ranch agreement will significantly expand our business, and we are actively pursuing additional development opportunities in areas near Sky Ranch, as well as acquisition opportunities to continue to grow our operations. We currently have only three employees to administer our existing assets, interface with applicable governmental bodies and

9

investors, market our services, and plan for the construction and development of our future assets. We may not be able to maximize the value of our water assets because of our limited manpower. We depend significantly on the services of Mark Harding, our President, and Thomas P. Clark, our Chief Executive Officer. Loss of either of these employees would cause a significant interruption of our operations. The success of our future business development and ability to capitalize on growth opportunities depends on our ability to attract and retain additional experienced and qualified persons to operate and manage our business. State regulations set the training, experience and qualification standards required for our employees to operate specific water and wastewater facilities. Failure to find state-certified and qualified employees to support the operation of our facilities could put us at risk, among other things, for operational errors at the facilities, for improper billing and collection processes, and for loss of contracts and revenues. We cannot assure you that we can successfully manage our assets and our growth.

Our business is subject to governmental regulation and permitting requirements. We may be adversely affected by any future decision by the Colorado Public Utilities Commission to regulate us as a public utility and to impose regulation.

The Colorado Public Utilities Commission (CPUC) regulates investor-owned water companies that hold themselves out to the public as serving, or ready to serve, all of the public in a service area. The CPUC regulates many aspects of public utilities' operations, including the siting and construction of facilities, establishing water rates and fees, initiating inspections, enforcement and compliance activities and assisting consumers with complaints. Although we act as a service provider under contracts with quasi-municipal metropolitan districts that are exempt by statute from regulation by the CPUC, the CPUC could decide to regulate us as a public utility. If this were to occur, we might incur significant expense challenging the CPUC's assertion of authority, and we may be unsuccessful. In the future, existing regulations may be revised or reinterpreted, and new laws and regulations may be adopted or become applicable to us or our facilities. If we become regulated as a public utility, our ability to generate profits could be limited and we might incur significant costs associated with regulatory compliance.

Water is a depleting resource and we may not be able to provide an adequate supply of water to our customers.

We obtain our water from various sources. The preferred source is pumping tributary groundwater from the alluvial aquifer beneath or connected with the surface streams located on the Lowry Range. Although a relatively small portion of our water supply comes from these renewable surface water supplies, the volume of water available through surface water rights are subject to a priority system which, particularly in times of drought, may diminish the supply of available water. A significant portion of our water supply comes from nontributary groundwater that can only be withdrawn at an average rate of 1% per year so that the resource, which is thought to be non-renewable, will last for 100 years. Water court decrees are based on engineering estimates of the amount of water contained in the aquifer. Actual amounts of water may vary from these estimates as the aquifer is developed. In addition, frequently, after a certain number of years, it becomes more difficult to extract the water from the aquifer, resulting in higher costs of extraction. Our obligations to deliver water are fixed obligations, and are not conditioned on the continuing availability of water from our existing supplies. If our water supply is depleted, we would be obligated to acquire water elsewhere in order to meet our contractual obligations, and the cost of that replacement water could exceed the amount we are permitted to charge to water users. We will seek to recycle and reuse our existing water assets and to replenish and increase our water rights through acquisition of additional tributary and nontributary water rights, but we cannot assure you that we will continue to have sufficient supplies of water in the future to meet our customers' needs and to support continued growth.

10

Our water rights may be challenged based on changes in water law and policy.

Our rights to our water assets have been adjudicated by Colorado water courts, but it is not possible to obtain title insurance on water rights. We believe that adjudicated water rights constitute property interests that are not subject to subsequent challenge. However, the evolving nature of water law in Colorado and the political sensitivity and importance of water as a scarce commodity could lead to challenges to our adjudicated water rights. We cannot assure you that we will be successful in defeating all such challenges.

There are many obstacles to our ability to realize on our Paradise water assets.

We currently earn no revenues from our Paradise water assets, which as of February 29, 2004 are recorded at $5,498,124. Our ability to convert our Paradise water supply into an income generating asset is limited. While there is demand for water in the downstream states of California, Nevada and Arizona, Colorado law prohibits the export of water out of state without obtaining a Water Court decree. To issue a decree the Water Court must find that the export is not in violation of the provisions of interstate compacts and does not prevent Colorado from complying with its interstate compact obligations. In addition, there are significant difficulties and costs involved in transporting the water out of the Colorado River watershed to the Denver metropolitan area. As part of our Water Court decree for the Paradise water, we are permitted to construct a storage facility on the Colorado River. However, due to the strict regulatory requirements for constructing an on-channel reservoir, completing the conditional storage right at its decreed location would also be difficult. Our Paradise water right is also conditioned on a Finding of Reasonable Diligence from the water court every six years. To arrive at that finding, a water court must determine that we are continuing diligently to pursue the actual use of the water right by us or by some third party who has a contractual commitment for its use. If the water court is unable to make such a finding, our right to the Paradise water may be lost. The next such finding will be required to be made in 2005. To date, the required finding has been made at each six-year period. If challenged, we intend to vigorously defend our Paradise asset. We cannot assure you that we will ever be able to make use of this asset or sell the water profitably.

Conflicts of interest may arise relating to the operation of the Rangeview Metropolitan District.

Our officers and employees constitute a majority of the directors of the Rangeview Metropolitan District and Pure Cycle, along with our officers and employees and one unrelated individual, own as tenants in common the 40 acres that form the District. We have made loans to the District to fund its operations. At February 29, 2004, total principal and interest owed to us by the District was approximately $400,000. The District is a party to our agreements with the State Land Board and receives fees of 5% of the revenues from the sale of water on the Lowry Range, and will hold title to the water distribution system at the Sky Ranch development. Proceeds from the fee collections will initially be used to repay the District's obligations to us, but after these loans are repaid, the District is not required to use the funds to benefit Pure Cycle. Officers and directors of Pure Cycle that serve as directors of the Rangeview Metropolitan District will not benefit from the fees to be paid to the District other than nominal director fees. We have received benefits from our activities undertaken in conjunction with the District, but conflicts may arise between our interests and those of the District, and with our officers who are acting in dual capacities in negotiating contracts to which both we and the District are parties. We expect that the District will expand when more properties are developed and become part of the District, and our officers acting as directors of the District will have fiduciary obligations to those other constituents. There can be no assurance that all conflicts will be resolved in the best interests of Pure Cycle and its stockholders. In addition, other landowners coming into the District will be eligible to vote and to serve as directors of the District. There can be no assurances that our officers and employees will remain as directors of the District or that the actions of a subsequently elected board would not have an adverse impact on our operations.

11

Weather conditions can impact our financial results and operations.

Rainfall and weather conditions may affect our operations, with most water consumption occurring during the summer months when weather tends to be hot and dry. Drought or unusually wet conditions may also adversely impact our results of operations. During a drought, we may experience lower revenues, due to consumer conservation efforts and regulatory mandates. Since a fairly high percentage of our water is used outside our customers' homes, unusually wet conditions could result in decreased customer demand and lower revenues. In addition, heavy rainfall may limit our ability to perform certain work such as pipeline maintenance, manhole rehabilitation and other outdoor services.

We are required to maintain stringent water quality standards and are subject to regulatory and environmental risks.

We must provide water that meets all federal and state regulatory water quality standards and operate our water and wastewater facilities in accordance with the standards. We face contamination and pollution issues regarding our water supplies. Improved detection technology, increasingly stringent regulatory requirements, and heightened consumer awareness of water quality issues contribute to an environment of increased focus on water quality. In contrast with other providers in Colorado, we are combining the water delivery and wastewater treatment processes, which may introduce technical treatment issues that make compliance with water quality standards more difficult. We plan to return effluent wastewater for irrigation and other nonpotable uses, although the Colorado Department of Public Health and Environment is currently evaluating the use of effluent wastewater for residential irrigation. We cannot assure you that we will be able in the future to reduce the amounts of contaminants in our water to acceptable levels. In addition, the standards that we must meet are constantly changing and becoming more stringent. For example, in February 2002, the U.S. Environmental Protection Agency lowered the arsenic standard in drinking water from 50 parts per billion to 10 parts per billion. Future changes in regulations governing the supply of drinking water and treatment of wastewater may have a material adverse impact on our financial results.

We handle certain hazardous materials at our water treatment facilities, primarily sodium hypochlorite. Any failure of our operation of the facilities in the future, including sewage spills, noncompliance with water quality standards, hazardous materials leaks and spills, and similar events could expose us to environmental liabilities, claims and litigation costs. We cannot assure you that we will successfully manage these issues, and failure to do so could have a material adverse effect on our future results of operations by increasing our costs for damages and cleanup.

We have engaged in transactions with related parties.

We have engaged in transactions, particularly the issuance of debt and equity securities, with related parties, most significantly our chief executive officer, Mr. Thomas P. Clark. Mr. Clark beneficially owns approximately 31% of our common stock. In addition, we have outstanding borrowings at February 29, 2004 totaling $546,163 from Mr. Clark and $402,104 from other stockholders who hold 10% or more of our common stock, and have issued warrants to certain investors in connection with these loans. Those related party lenders have been willing to forgo periodic payments of principal and interest on such debt. Many of the Selling Stockholders are related parties that have engaged in transactions with Pure Cycle. There can be no assurance that our equity and debt issuances or other related party transactions have been on arms length terms.

Our contracts for the construction of water and wastewater projects may expose us to certain completion and performance risks.

We will rely on independent contractors to construct our water and wastewater facilities. These construction activities may involve risks, including shortages of materials and labor, work stoppages,

12

labor relations disputes, weather interference, engineering, environmental, permitting or geological problems and unanticipated cost increases. These issues could give rise to delays, cost overruns or performance deficiencies, or otherwise adversely affect the construction or operation of the water delivery system.

In addition, we may experience quality problems in the construction of our systems and facilities, including equipment failures. We cannot assure you that we will not face claims from customers or others regarding product quality and installation of equipment placed in service by contractors.

Certain of our contracts may be fixed-price contracts, in which we may bear all, or a significant portion of, the risk for cost overruns. Under these fixed-price contracts, contract prices are established in part based on fixed, firm subcontractor quotes on contracts and on cost and scheduling estimates. These estimates may be based on a number of assumptions, including assumptions about prices and availability of labor, equipment and materials, and other issues. If these subcontractor quotations or cost estimates prove inaccurate, or if circumstances change, cost overruns may occur, and our financial results would be negatively impacted. In many cases, the incurrence of these additional costs are not within our control.

We may have contracts in which we guarantee project completion by a scheduled date. At times, we may guarantee that the project, when completed, will achieve certain performance standards. If we fail to complete the project as scheduled, or if we fail to meet guaranteed performance standards, we may be held responsible for cost impacts and/or penalties to the customer resulting from any delay or for the costs to alter the project to achieve the performance standards. To the extent that these events occur, and are not due to circumstances for which the customer accepts responsibility, and cannot be mitigated by performance bonds or the provisions of our agreements with contractors, the total costs of the project would exceed our original estimates and our financial results would be negatively impacted.

Our customers may require us to secure performance and completion bonds for certain contracts and projects. The market environment for surety companies has become more risk averse. We secure performance and completion bonds for our contracts from these surety companies. To the extent we are unable to obtain bonds, we may not be awarded new contracts. We cannot assure you that we can secure performance and completion bonds where required.

We may operate engineering and construction activities for water and wastewater facilities where design, construction or system failures could result in injury to third parties or damage to property. Any losses that exceed claims against our contractors, the performance bonds and our insurance limits at facilities so managed could result in claims against us. In addition, if there is a customer dispute regarding performance of our services, the customer may decide to delay or withhold payment to us.

Our contract to provide water services to the Lowry Range terminates in 2081.

Our contract with the Rangeview Metropolitan District grants us the exclusive right to use water underlying the Lowry Range and to provide water to customers on the Lowry Range until 2081, at which time ownership and control of the water delivery system (other than the wastewater system) reverts to the State Land Board and our ability to use such water to serve customers on the Lowry Range will cease. While we may negotiate a new agreement to operate the water assets, the selection process will be competitive and there can be no assurance that we would continue as operator. In such event, our receipt of the monthly water usage fees will terminate with respect to all customers located on the Lowry Range. We estimate that our income from Lowry Range customers will represent a significant component of our overall revenues at such date, so the loss of such revenues will be material.

13

We will have broad discretion in allocation of net proceeds to us in this offering.

Approximately $3,358,564, or 59%, of the estimated net proceeds to us in this offering has been allocated to working capital and general corporate purposes. Accordingly, our management will have broad discretion as to the application of these proceeds. We may use a portion of the proceeds allocated to working capital for acquisitions and to purchase contract rights under the Commercialization Agreement. We currently have no agreement, arrangement or understanding with respect to any acquisition or purchase under the Commercialization Agreement.

The market price of our common stock could be volatile.

A number of factors could cause the market price of our common stock to fluctuate significantly, including:

Our reverse stock split may contribute to greater volatility in our stock price.

On April 26, 2004, we effected a 1-for-10 reverse split of our common stock with the goal of improving the liquidity of our stock by increasing the stock price and thereby increasing interest of a broader range of investors in our stock. While the initial post-split stock price has been proportionate to the reduction in the number of shares of common stock outstanding before the reverse stock split, if the market price of the common stock later declines, the percentage decline may be greater than would occur in the absence of the reverse stock split and the market price per share of our common stock could be more volatile as a result of the stock split. We cannot assure you that even after the reverse stock split, our share price will attract new investors or that our share price will satisfy the investing guidelines of institutional investors. As a result, the trading liquidity of the common stock may not necessarily improve.

Future sales of our common stock may cause our stock price to decline.

At the conclusion of this offering, we will have outstanding options and warrants to purchase 3,670,917 shares of common stock with an exercise price of $1.80 per share, 1,058,000 shares of Series A-1 preferred stock that are convertible into 587,778 shares of common stock and a stock option plan that permits the issuance of options to purchase an additional 1,585,000 shares of common stock. We have been informed that a number of warrantholders intend to exercise their warrants following this offering. Such exercises are likely to be on a net or cashless exercise basis, resulting in the issuance of shares that may not be subject to holding period restrictions on transfer under Rule 144 of the

14

Securities Act. Holders of 3,128,706 shares of common stock, options to purchase 2,124,411 shares, warrants to purchase 1,320,112 shares and Series A-1 preferred stock that converts into 559,999 shares of common stock have agreed with the underwriter not to sell any shares for 180 days following completion of this offering. Sales of substantial amounts of common stock by our stockholders, including shares issued upon the exercise of outstanding options and warrants, or even the potential for such sales, may have a depressive effect on the market price of our common stock and could impair our ability to raise capital through the sale of our equity securities.

This prospectus contains certain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 with respect to our financial condition, results of operations and business. The words "anticipate," "believe," "estimate," "expect," "plan," "intend" and similar expressions, as they relate to us, are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions. We cannot assure you that any of our expectations will be realized. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, without limitation, the timing of development of the areas where we are selling our water, the market price of water, changes in applicable statutory and regulatory requirements, uncertainties in the estimation of water available under decrees, costs of delivery of water, uncertainties in the estimation of revenues and costs of construction projects, the strength and financial resources of our competitors, our ability to find and retain skilled personnel, climatic conditions, labor relations, availability and cost of material and equipment, delays in anticipated permit and construction dates, environmental risks, the results of financing efforts and the ability to meet capital requirements, and general economic conditions.

15

We estimate that the net proceeds from the sale of the shares of common stock we are offering will be approximately $5,667,625, assuming a stock price of $9.00 per share in this offering. If the underwriter fully exercises its over-allotment option, the net proceeds of the shares we sell will be approximately $9,708,190. "Net proceeds" is what we expect to receive after paying the underwriting discount and other expenses of the offering.

The following table summarizes the use of the net proceeds that we will receive from this offering:

| Repayment of outstanding debt to related parties | $ | 1,109,061 | 20 | % | |||

| Water system expenditures | $ | 1,200,000 | 21 | % | |||

| Working capital and general corporate purposes | $ | 3,358,564 | 59 | % | |||

| Total | $ | 5,667,625 | 100 | % | |||

$512,439 of the debt to be repaid bears interest at prime plus 2% (6% at May 27, 2004) and $596,622 bears interest at 10.25%. All debt to be repaid matures in August 2007. One of the creditors to be repaid is the Harrison Augur Money Purchase Plan, which is affiliated with one of our directors. Net proceeds payable to this creditor will be $86,513. The remaining holders of this indebtedness are all selling stockholders: Apex Investment Fund II, L.P., Proactive Partners, L.P., Environmental Venture Fund Liquidating Trust, Environmental Private Equity Fund II, L.P., The Productivity Fund II, L.P., and Gregory M. Morey. Accordingly, these persons will also receive proceeds from the sale of shares in the offering.

The net proceeds allocated to water system expenditures will be used to drill wells and build the infrastructure needed to provide water services to Sky Ranch.

We anticipate that a portion of the proceeds allocated to working capital and general corporate purposes will be used for acquisition of water rights and acquisition of contractual rights to receive payments under the Commercialization Agreement, in each case if and to the extent agreements can be reached. Amounts to be utilized for these purposes will depend on the opportunities that arise, but we do not expect to spend more than $5,000,000 on acquisition of water rights or more than $3,600,000 on purchase of contract rights under the Commercialization Agreement. We are not currently in discussions regarding any specific acquisition of water rights.

We intend following the completion of this offering to approach certain of the persons who have contractual rights to receive payments under the Commercialization Agreement and offer to buy out a portion of those contractual rights. We have had preliminary discussions regarding such purchases with some of the parties to the Commercialization Agreement, but no firm commitments have been made regarding any such sale. Many of the selling stockholders that are exercising warrants are parties to the Commercialization Agreement. Accordingly, if we purchase their contract rights, they will receive additional proceeds from this offering. No assurance can be given that any of the parties to the Commercialization Agreement will be willing to sell their contract rights at all or on terms that would be acceptable to us.

While the amounts indicated above reflect what we currently expect to spend on these matters, opportunities may arise that cause us to change the allocation of proceeds among the categories described. Prior to using the net proceeds, we plan to invest the net proceeds in bank deposits or short-term interest-bearing investment grade securities.

Many of the selling stockholders are exercising options or warrants immediately prior to the completion of this offering to obtain the shares to be sold in this offering. In connection with this exercise, we will receive $2,491,860, $1,632,774 of which will be paid in the form of promissory notes secured by the shares we issue. The selling stockholders will pay the promissory notes with the proceeds of this offering. We are paying the expenses, other than underwriting discounts and expenses of separate counsel for the selling stockholders, relating to the sale of the selling stockholder shares.

16

The following table sets forth:

| |

As of February 29, 2004 |

||||||

|---|---|---|---|---|---|---|---|

| |

Actual |

As Adjusted |

|||||

| Cash and cash equivalents | $ | 338,599 | 6,189,023 | ||||

| Current liabilities | 44,650 | 44,650 | |||||

| Long-term debt—related parties, including accrued interest | 4,976,511 | 3,867,450 | |||||

Participating interests in Rangeview water rights |

11,090,630 |

11,090,630 |

|||||

Preferred stock, par value $.001 per share; authorized—25,000,000 shares: |

|||||||

Series A-1—1,058,000 shares issued and outstanding actual and as adjusted |

1,058 |

1,058 |

|||||

Series B—432,514 shares issued and outstanding actual and as adjusted |

433 |

433 |

|||||

Series D—6,455,000 shares issued and outstanding actual, no shares issued and outstanding as adjusted |

6,455 |

— |

|||||

Series D-1—2,000,000 shares issued and outstanding actual, no shares issued and outstanding as adjusted |

2,000 |

— |

|||||

Common stock, par value 1/3 of $.01 per share; authorized—135,000,000 shares actual, 225,000,000 shares as adjusted; 8,145,087 shares issued and outstanding actual, 11,074,954 shares issued and outstanding as adjusted |

27,123 |

36,880 |

|||||

Additional paid in capital |

25,511,992 |

33,670,175 |

|||||

Accumulated deficit |

(21,406,554 |

) |

(21,406,554 |

) |

|||

Total stockholders' equity |

4,142,507 |

12,301,992 |

|||||

Total noncurrent liabilities and stockholders' equity |

20,209,648 |

27,260,072 |

|||||

17

MARKET PRICE OF AND DIVIDENDS FOR OUR COMMON EQUITY

AND RELATED STOCKHOLDER MATTERS

Our common stock is quoted on the OTC Bulletin Board under the symbol "PCYO." We have applied for listing of our common stock on the NASDAQ SmallCap under the symbol "PCYO". The following table shows, for the fiscal periods indicated, the high and low sales prices for our common stock as reported by the OTC Bulletin Board.

| |

Low |

High |

||||

|---|---|---|---|---|---|---|

| Fiscal 2004 | ||||||

| First Quarter | $ | 2.00 | $ | 5.10 | ||

| Second Quarter | 4.00 | 13.00 | ||||

| Third Quarter | 6.00 | 10.70 | ||||

| Fourth Quarter (through June 18, 2004) | 9.00 | 10.25 | ||||

Fiscal 2003 |

||||||

| First Quarter | $ | .90 | $ | 1.80 | ||

| Second Quarter | 1.00 | 2.80 | ||||

| Third Quarter | 1.60 | 2.70 | ||||

| Fourth Quarter | 1.70 | 3.00 | ||||

Fiscal 2002 |

||||||

| First Quarter | $ | .80 | $ | 1.50 | ||

| Second Quarter | .60 | 1.20 | ||||

| Third Quarter | .60 | 2.10 | ||||

| Fourth Quarter | .90 | 1.90 | ||||

On June 18, 2004, the last reported sale price of our common stock on the OTC Bulletin Board was $9.50 per share. As of May 31, 2004, there were approximately 3,751 holders of record of our common stock.

We have never paid any dividends on our common stock and expect for the foreseeable future to retain all of our earnings from operations for use in expanding and developing our business. Any future decision as to the payment of dividends will be at the discretion of our board of directors and will depend upon our earnings, financial position, capital requirements, plans for expansion and such other factors as our board of directors deems relevant. The terms of our Series A-1 Preferred Stock and Series B Preferred Stock prohibit the payment of dividends on common stock unless all dividends accrued on such series of preferred stock have been paid. See "Description of Securities—Series A-1 Convertible Preferred Stock" and "—Series B Preferred Stock."

18

This section presents our selected historical financial data. You should read carefully the financial statements included in this prospectus, including the notes to the financial statements. The selected data in this section is not intended to replace the financial statements.

The following tables as of August 31, 2003 and 2002 and for each of the years in the two year period ended August 31, 2003, and as of February 29, 2004 and February 28, 2003 and for the six month periods ended February 29, 2004 and February 28, 2003, present selected financial information of the Company which has been derived from our financial statements included elsewhere in this prospectus. The financial statements as of August 31, 2003 and 2002 and for the two years ended August 31, 2003 have been audited by KPMG LLP, our independent auditors. The consolidated balance sheet data at February 29, 2004 and February 28, 2003 and the consolidated statement of operations data for the six months ended February 29, 2004 and February 28, 2003 are derived from unaudited financial statements which have been prepared on the same basis as the audited annual financial statements and, in the opinion of management, contain all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the consolidated position at such dates and the operating results for such periods. Operating results for the six months ended February 29, 2004 are not necessarily indicative of the results that may be expected for the year ending August 31, 2004. This selected financial data should be read in conjunction with the consolidated financial statements of Pure Cycle and notes thereto, and Management's Discussion and Analysis of Financial Condition and Results of Operations, included elsewhere in this prospectus.

| |

Six Months Ended |

Year Ended |

||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |

Feb. 29, 2004 |

Feb. 28, 2003 |

August 31, 2003 |

August 31, 2002 |

||||||||||

| |

(Unaudited) |

|

|

|||||||||||

| Statement of Operations | ||||||||||||||

| Revenues | $ | 85,731 | $ | 103,812 | $ | 225,432 | $ | 204,858 | ||||||

| Expenses: | ||||||||||||||

| Operating | 11,338 | 10,732 | 37,496 | 27,792 | ||||||||||

| General and administrative | 219,302 | 124,556 | 318,182 | 221,872 | ||||||||||

| Operating loss | (147,691 | ) | (34,784 | ) | (135,841 | ) | (49,764 | ) | ||||||

| Other expense, net | 91,259 | 92,572 | 185,212 | 195,383 | ||||||||||

Net loss |

(238,950 |

) |

(127,356 |

) |

(321,043 |

) |

(245,147 |

) |

||||||

Basic and diluted net loss per common share |

$ |

(0.03 |

) |

$ |

(0.02 |

) |

$ |

(0.04 |

) |

$ |

(0.03 |

) |

||

| Weighted average number of shares of common stock outstanding—basic and diluted | 8,056,418 | 7,843,976 | 7,843,976 | 7,843,976 | ||||||||||

| |

February 29, 2004 |

August 31, 2003 |

August 31, 2002 |

||||||

|---|---|---|---|---|---|---|---|---|---|

| Balance Sheet Data: | |||||||||

| Cash and cash equivalents | $ | 338,559 | $ | 525,780 | $ | 287,720 | |||

| Investment in water and systems, net | 19,410,635 | 19,342,994 | 19,201,683 | ||||||

| Total assets | 20,254,298 | 20,413,404 | 20,028,279 | ||||||

| Working capital | 327,790 | 541,695 | 316,760 | ||||||

| Long-term debt-related parties, including accrued interest | 4,976,511 | 4,889,545 | 4,713,270 | ||||||

| Participating interests in Rangeview water supply | 11,090,630 | 11,090,630 | 11,090,630 | ||||||

| Stockholders' equity | 4,142,507 | 4,381,457 | 4,202,500 | ||||||

19

MANAGEMENT'S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS

You should read this discussion together with the financial statements and other financial information included in this prospectus. This prospectus contains forward-looking statements that involve risks and uncertainties. Our actual results may differ materially from those indicated in the forward-looking statements. Please see "Forward-Looking Statements" elsewhere in this prospectus.

General

We own or have rights to use significant water assets which we have begun to utilize to provide water and wastewater services to customers located in the Denver, Colorado metropolitan area near our principal water assets. We will operate water and wastewater systems to deliver and treat the water we provide. Our services will include designing, constructing, operating and maintaining systems to service our customers.

We have exclusive access to approximately 29,000 acre feet per year of water from, and the exclusive right to provide water and wastewater services to, 24,000 acres of primarily undeveloped land in eastern Colorado known as the Lowry Range. The Lowry Range is located in Arapahoe County approximately 15 miles southeast of Denver and 12 miles south of the Denver International Airport. Of the approximately 29,000 acre feet of water to which we have access, 17,500 acre feet are available to us for use on the Lowry Range. We own the remaining 11,650 acre feet and can "export" it from the Lowry Range to supply water to communities and developers in need of additional water supplies. There are no legal limitations on the locations outside of the Lowry Range in which we can sell Export Water, except that, if we sell Export Water for use outside of Arapahoe County, we are required to offer to Arapahoe County the right to buy such water at the same rates. We acquired these rights and the Export Water in 1996 when we entered into an agreement with the State Land Board, which owns the Lowry Range, and 85-year agreements with the District.

The 17,500 acre feet of water designated for use within the Lowry Range service area is capable of providing water service to approximately 47,000 SFE units. We will design, construct, operate and maintain the water and wastewater systems on the Lowry Range service area on behalf of the District and the State Land Board. The District will own all water and wastewater facilities constructed to serve customers in the Lowry Range service area during our contract service period. At the end of our contract service period, ownership of the water facilities will revert to the State Land Board.

Our annual entitlements to 11,650 acre feet of surface water and groundwater on and beneath the Lowry Range service area can be developed for "export" off the property to service approximately 32,000 SFE equivalent customers outside of the Lowry Range service area. We will design, construct, operate and maintain facilities for water and/or wastewater service for customers located off the Lowry Range service area and we will own these facilities.

Water and/or wastewater service, whether to customers located in the Lowry Range service area or off the Lowry Range service area, is subject to individual water and wastewater service agreements. We will negotiate individual service agreements with developers and/or homebuilders to provide water and wastewater service. Our service contracts will outline our obligations to construct certain facilities necessary to develop and treat water and/or wastewater, including the timing of installation of the facilities, capacities of the systems, and where the services will be provided. Developers and/or homebuilders are required to purchase water and/or wastewater taps from us in exchange for our obligation to construct the water and/or wastewater facilities.

Revenues we earn from providing water and/or wastewater service are divided into two components: one-time tap fees, which are generally paid by the developer, and service charges, which are monthly charges based on metered water delivery or wastewater usage. Water tap fees are further

20

divided into two components: system development fees, which are used to construct facilities necessary to develop and treat water and/or wastewater; and water resource fees, which are used to defray the acquisition costs of the water rights. We are generally required to use the water resource portion of the tap fees received from water exported off the Lowry Range service area to repay investors. Under the Commercialization Agreement that we entered into in conjunction with our agreement to obtain our Rangeview water assets, we are obligated to pay investors that are parties to the Commercialization Agreement the first approximately $32,000,000 from the water resource fees we receive from the sale of the Export Water. In another agreement (the "LCH Agreement"), we agreed to pay the next $4,000,000 of these revenues to another investor. Under the terms of our certificate of designations for the Series B preferred stock, we are obligated to pay the next $433,000 of these revenues to the holders of our Series B preferred stock (collectively, the Commercialization Agreement, the LCH Agreement and the Series B preferred stock are referred to as the "Financing Agreements"). We will retain 100% of the water resource fees we receive in excess of $36,240,000 from tap fees we receive from sale of Export Water, to the extent such fees are not required to be used to defray infrastructure costs.

In agreements marketing our Export Water, developers that own rights to groundwater underlying their property may choose to dedicate the water to us for service to their properties, in exchange for credit against a portion of their water resource fees. Such dedicated water would not be subject to obligations under any Financing Agreements. Similarly, water resource fees received from the sale of taps to customers located in the Lowry Range service area are not subject to obligations under any Financing Agreements.

Due to the continuing growth of the Denver metropolitan region and the limited availability of new water supplies, many metropolitan planning agencies are requiring property developers to first demonstrate adequate water availability prior to any consideration for zoning requests for property development. As a result, we believe we are well positioned to market and sell our water and wastewater services to developers and home builders seeking to develop new communities both within the Lowry Range service area as well as in other areas in the Denver metropolitan region.

We also own conditional water rights in western Colorado enabling us to build a 70,000 acre-foot reservoir to store tributary water on the Colorado River, a right-of-way permit from the U.S. Bureau of Land Management for property at the dam and reservoir site, and four tributary water wells with a theoretical capacity to produce approximately 56,000 acre feet of water annually (collectively known as the Paradise Water Supply). Although we will seek to utilize the Paradise Water Supply to deliver water to customers located in the Denver metropolitan area or to customers in the downstream states of Nevada, Arizona and California, legal issues relating to interstate water transfers and inter-basin water transfers make the short-term realization on these assets unlikely.

The State Land Board is in the initial stages of developing a plan to solicit requests for proposals this summer to engage a development partner to assist in the planning for future development of the Lowry Range. We are not able to determine the timing of development of property in and around the Lowry Range service area, although residential, commercial and industrial development is under way outside of the Lowry Range service area along its southern, western and northern borders, and we anticipate that initial development of Sky Ranch will begin shortly. Water sales will only occur after development has commenced. We cannot assure you regarding the pace of development or that water sales can be made on terms acceptable to us. In the event development of the property within the Lowry Range service area or of Sky Ranch and surrounding areas is delayed, we may be required to incur additional short or long-term debt obligations or seek to sell equity services to generate operating capital.

21

Critical Accounting Policies

Our financial statements are prepared in accordance with accounting principles generally accepted in the United States of America ("GAAP"). The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and reported amounts of revenues and expenses during the reporting period. Actual results could differ significantly from those estimates.

We have identified certain key accounting policies on which our financial condition and results of operations are dependent. These key accounting policies most often involve complex matters or are based on subjective judgments or decisions. In the opinion of management, our most critical accounting policies are those related to revenue recognition, impairment of water assets and other long-lived assets, depletion and depreciation, accounting for participating interests, royalty and other obligations, and income taxes. Management periodically reviews its estimates, including those related to the recoverability and useful lives of assets. Changes in facts and circumstances may result in revised estimates.

Revenue Recognition

For customers located on the Lowry Range service area, the District will sell the taps and contract with us to construct the water delivery infrastructure. We will recognize revenues relating to tap fees on the Lowry Range service area as construction project income using the percentage-of-completion method, measured by the contract costs incurred to date as a percentage of the estimated total contract costs. Since we do not own the facilities constructed for customers located in the Lowry Range service area, we believe the treatment of these revenues as construction project income is the most correct accounting methodology. Contract costs include all direct material, labor and equipment costs and those indirect costs related to contract performance, such as indirect labor and supplies costs. If the construction project revenue is not fixed, we estimate revenues that are most likely to occur. Provisions for estimated losses on uncompleted contracts are made in the period in which such losses are determined. Billings in excess of costs and estimated earnings represent payments received on construction projects for which the work has not been completed. These amounts, if any, are recognized as construction progresses in accordance with the percentage-of-completion method.

We will recognize revenues from the sale of taps relating to properties located off the Lowry Range service area, and related costs of providing water access, as water service is made available to the property under the tap fee agreement.

We recognize water and wastewater service revenues as services are performed, which are based upon metered water deliveries to customers or a flat fee per SFE. We recognize costs of delivering water and processing wastewater as incurred.

Impairment of Water Assets and Other Long-Lived Assets

We review our long-lived assets for impairment whenever events or changes in circumstances indicate that the carrying amount of an asset may not be recoverable. We measure recoverability of assets to be held and used by a comparison of the carrying amount of an asset to future undiscounted net cash flows we expect to be generated by the asset. If such assets are considered to be impaired, the impairment to be recognized is measured by the amount by which the carrying amount of the assets exceed the fair value of the assets. We report assets to be disposed of at the lower of the carrying amount or fair value less costs to sell. We believe there were no impairments in the carrying amounts of our investments in water and water systems at February 29, 2004.

22

We deplete our water assets on the basis of units produced divided by the total volume of water adjudicated in the water decrees. Water and wastewater facilities we own are depreciated on a straight line basis over their estimated useful lives.

Accounting for Participating Interests

The balance sheet liability captioned "participating interests in Rangeview water supply" represents an obligation which arose under the Commercialization Agreement. We recorded a liability of $11.1 million, which represents the cash we received and applied to the purchase of the Rangeview water assets. The remainder of the participating interest of $20.7 million represents a contingent return to the financing investors, Series A-1 preferred stockholders, and the sellers of the Rangeview water assets that are parties to the Commercialization Agreement. These amounts, totaling $31.8 million, will only be payable from the water resource portion of the tap fees we receive from the sale of Export Water. As we recognize revenues from the sale of Export Water to make payments to investors, we will allocate a ratable percentage of the repayment to the principal portion of the participating interest represented by the $11.1 million (i.e., 35%), and the balance to the expense portion, $20.7 million (i.e., 65%), as amounts are payable. The portion allocated to the principal portion will be recorded as a reduction in participating interest in Rangeview water supply.

Royalty and other obligations

Pursuant to our service agreements, royalties we incur relating to gross revenues received will be expensed in the same period that the revenue is recognized.

Income taxes

We use the asset and liability method of accounting for income taxes. Under the asset and liability method, deferred tax assets and liabilities are recognized for the estimated future tax consequences attributable to differences between the financial statement carrying amounts of existing assets and liabilities and their respective tax bases. Deferred tax assets and liabilities are measured using enacted tax rates expected to apply to taxable income in the years in which we expect to recover or settle those temporary differences. The effect on deferred tax assets and liabilities of a change in tax rates is recognized in income in the period that includes the enactment date. A valuation allowance is provided for deferred tax assets until realization is more likely than not.

Results of Operations

Year Ended August 31, 2003 Compared with Year Ended August 31, 2002

During fiscal 2003, we delivered approximately 47.3 million gallons of water generating water usage revenues of $156,217 from the sale of water to customers within the Lowry Range service area, compared to the delivery of 54.5 million gallons of water generating revenues of $156,026 for fiscal 2002. Our water service charges are based on a tiered pricing structure that provides for higher prices as customers use greater amounts of water. The following table outlines our tiered pricing structure:

| Consumption (1,000 gallons/month) |

Price ($/1,000 gallons) |

||

|---|---|---|---|

| 0 to 10 | $ | 2.40 | |

| >10 to 20 | $ | 3.10 | |

| >20 | $ | 5.40 | |

23