UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant o

Check the appropriate box:

| o | Preliminary Proxy Statement |

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material pursuant to Section 240.14a-12 |

|

PURE CYCLE CORPORATION

|

|

(Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

|

Payment of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

|

|

|

|

|

o

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

|

|

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

o

|

Fee paid previously with preliminary materials:

|

|

|

|

|

|

|

o

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

PURE CYCLE CORPORATION

34501 E. Quincy Avenue

Bldg. 34, Box 10

Watkins, CO 80137

(303) 292-3456

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on January 15, 2020

TO PURE CYCLE’S SHAREHOLDERS:

You are cordially invited to attend the annual meeting of shareholders of Pure Cycle Corporation (the “Company”). The meeting will be held at 1550 Seventeenth Street, Suite 500, Denver, Colorado 80202, at the offices of Davis Graham & Stubbs LLP, on January 15, 2020 at 2:00 p.m. Mountain Time. The purposes of the meeting are to:

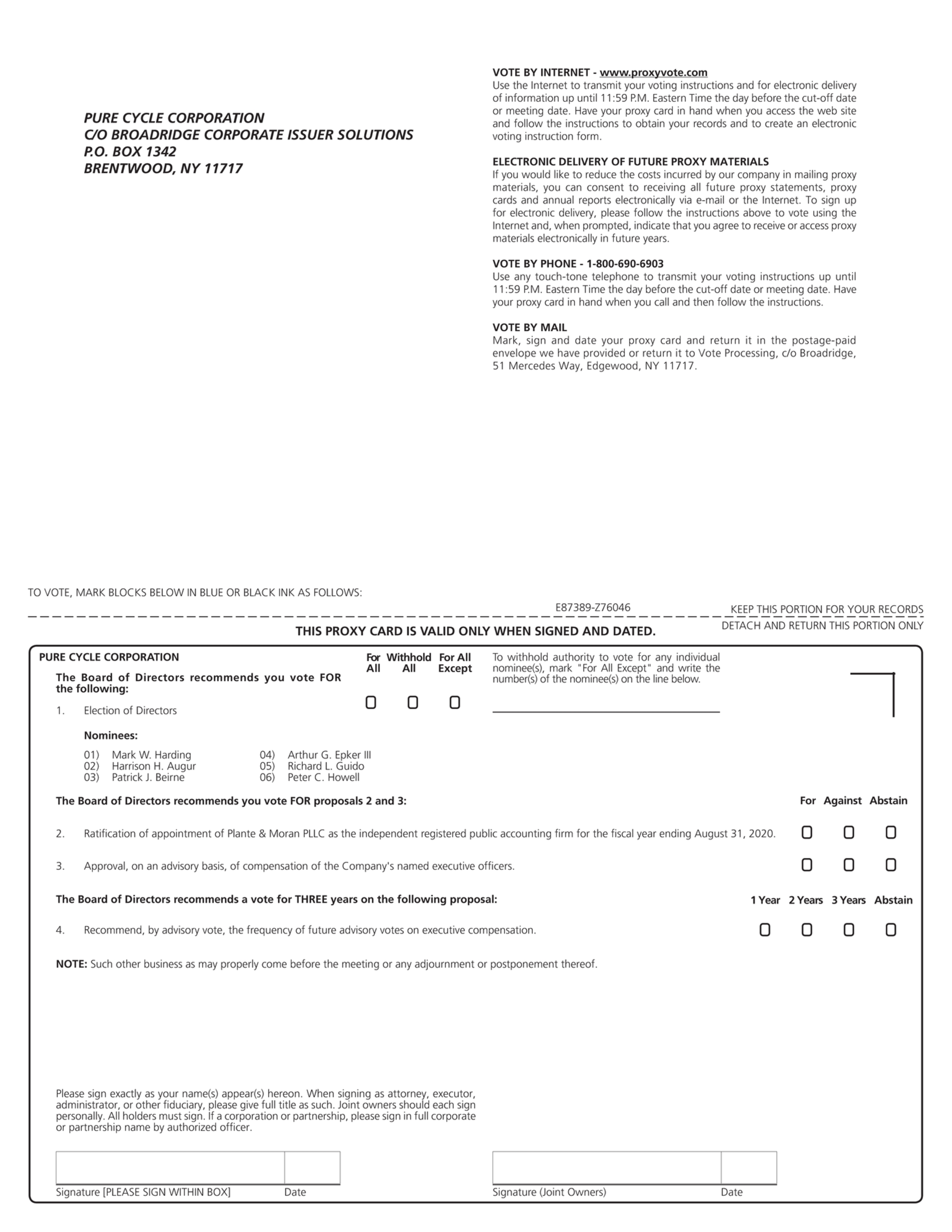

| 1. | Elect a board of six directors to serve until the next annual meeting of shareholders, or until their successors have been duly elected and qualified; |

| 2. | Ratify the appointment of Plante & Moran PLLC as the Company’s independent registered public accounting firm for the 2020 fiscal year; |

| 3. | Approve, on an advisory basis, the compensation of the Company’s named executive officer; |

| 4. | Vote, on an advisory basis, on the frequency of future advisory votes on executive compensation; and |

| 5. | Transact such other business as may properly come before the meeting or any adjournment(s) or postponement(s) thereof. |

Only shareholders of record as of 5:00 p.m. Mountain Time on November 18, 2019, will be entitled to notice of or to vote at this meeting or any adjournment(s) or postponement(s) thereof.

Whether or not you plan to attend, please vote promptly by following the instructions on the Important Notice Regarding the Availability of Proxy Materials or, if you requested a printed set of proxy materials, by completing, signing and dating the enclosed proxy and returning it in the accompanying postage-paid envelope. Shareholders who attend the meeting may revoke their proxies and vote in person if they so desire.

|

|

BY ORDER OF THE BOARD OF DIRECTORS

|

|

|

|

|

|

/s/ Mark W. Harding

|

|

|

Mark W. Harding, President

|

December 5, 2019

PURE CYCLE CORPORATION

34501 E. Quincy Avenue

Bldg. 34, Box 10

Watkins, CO 80137

(303) 292-3456

PROXY STATEMENT FOR THE

ANNUAL MEETING OF SHAREHOLDERS

To be held on January 15, 2020

This proxy statement is being made available to shareholders in connection with the solicitation of proxies by the board of directors of PURE CYCLE CORPORATION (the “Company,” “we” or “our”) to be voted at the annual meeting of shareholders of the Company (the “Meeting”) to be held at 1550 Seventeenth Street, Suite 500, Denver, Colorado 80202, at the offices of Davis Graham & Stubbs LLP on January 15, 2020, at 2:00 p.m. Mountain Time, or at any adjournment or postponement thereof. This proxy statement will be made available to shareholders on or about December 5, 2019. The cost of soliciting proxies is being paid by the Company. The Company’s officers, directors, and other regular employees may, without additional compensation, solicit proxies personally or by other appropriate means.

Pursuant to rules adopted by the Securities and Exchange Commission (“SEC”), the Company has elected to provide access to its proxy materials via the Internet. Accordingly, we are sending a Notice of Internet Availability of Proxy Materials (the “Notice”) to our shareholders, who will have the ability to access the proxy materials on the website referred to in the Notice or to request a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy can be found in the Notice. In addition, shareholders may request proxy materials in printed form by writing to the Company’s Secretary at the Company’s address set forth above.

If you would like to receive the Notice via email rather than regular mail in future years, please follow the instructions in the Notice. Choosing to receive future notices by email will help the Company reduce the costs and environmental impact of the Company’s shareholder meetings.

ABOUT THE MEETING

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders to be Held on January 15, 2020:

The proxy materials, including this proxy statement and the Company’s Annual Report on Form 10-K for the fiscal year ended August 31, 2019, are available at http://www.proxyvote.com.

What is the purpose of the Meeting?

At the Meeting, shareholders are asked to act upon the matters outlined above in the Notice of Annual Meeting of Shareholders and as described in this proxy statement. The matters to be considered are (1) the election of directors, (2) the ratification of the appointment of the Company’s independent registered public accounting firm for the fiscal year ending August 31, 2020, (3) the approval, on an advisory basis, of the compensation of the Company’s named executive officer, (4) the recommendation, by advisory vote, on the frequency of advisory voting on executive compensation, and (5) such other matters as may properly come before the Meeting. Management will be available to respond to appropriate questions.

Who is entitled to vote and how many votes do I have?

If you were a shareholder of record as of 5:00 p.m. Mountain Time on November 18, 2019, you will be entitled to vote at the Meeting or any adjournments or postponements thereof. On November 8, 2019, there were 23,826,598 shares of the Company’s 1/3 of $.01 par value common stock (“common stock”) issued and outstanding. Each outstanding share of the Company’s common stock will be entitled to one vote on each matter acted upon. There is no cumulative voting.

How do I vote?

If your shares are held in an account at a bank, brokerage firm, or other nominee in “street name,” you need to submit voting instructions to your bank, brokerage firm, or other nominee in order to cast your vote. If you wish to vote in person at the Meeting, you must obtain a valid proxy from the nominee that holds your shares. If you are the

shareholder of record, you may vote your shares by following the instructions in the Notice mailed on or about December 5, 2019, or, if you have received a printed set of the proxy materials, you may vote your shares by completing, signing and dating the enclosed proxy card and then mailing it to the Company’s transfer agent in the pre-addressed envelope provided. You may also vote your shares by calling the transfer agent at the number listed on the proxy card or by attending the Meeting in person.

Can I change or revoke my vote?

A proxy may be revoked by a shareholder any time before it is voted at the Meeting by submission of another proxy bearing a later date, by attending the Meeting and voting in person, or if you are a shareholder of record, by written notice of revocation to the Secretary of the Company.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed within the Company or to third parties, except (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, shareholders provide written comments on their proxy cards, which are forwarded to management of the Company.

Will my shares held in street name be voted if I do not provide my proxy?

If you hold your shares through a bank, broker, or other nominee, your shares must be voted by the nominee. If you do not provide voting instructions, under the rules of the securities exchanges, the nominee’s discretionary authority to vote your shares is limited to “routine” matters. Proposals 1, 3 and 4 are not considered routine matters for this purpose, so if you do not provide your proxy, your shares will not be voted at the Meeting with respect to these proposals. In this case, your shares will be treated as “broker non-votes” and will not be counted for purposes of determining the vote on these proposals.

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner has discretionary authority to vote on at least one matter at the meeting but does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that proposal and has not received voting instructions from the beneficial owner.

What is a quorum?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock constitutes a quorum at the Meeting for the election of directors and for the other proposals. Abstentions and broker non-votes are counted for the purposes of determining whether a quorum is present at the Meeting.

How many votes are required to approve the proposals?

| • | Election of Directors – The election of directors requires the affirmative vote of a plurality of the votes cast by shares represented in person or by proxy and entitled to vote for the election of directors. This means that the nominees receiving the most votes from those eligible to vote will be elected. You may vote “FOR” all of the nominees or your vote may be “WITHHELD” with respect to one or more of the nominees; however, a “withheld” vote or a broker non-vote (defined above) will have no effect on the outcome of the election. |

| • | Ratification of auditors, advisory vote on executive compensation, and other matters – The number of votes cast in favor of the proposal at the Meeting must exceed the number of votes cast against the proposal for the approval of Proposals 2, 3 and other matters. For Proposals 2, 3 and any other business matters to be voted on, you may vote “FOR,” “AGAINST,” or you may “ABSTAIN.” Abstentions and broker non-votes will not be counted as votes for or against a proposal and, therefore, have no effect on the vote. Because your vote on executive compensation is advisory, it will not be binding on the board of directors or the Company. However, the board of directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

2

| • | Frequency on advisory vote on executive compensation – With respect to the advisory vote regarding the frequency of future executive compensation advisory votes, shareholders may vote for a frequency of every one, two, or three years, or may abstain. The board of directors will consider the option that receives the most votes to be the option selected by our shareholders. Although the vote is advisory and not binding, the board of directors will review and consider the voting results when determining the frequency of shareholder voting on executive compensation. Abstentions and “broker non-votes” will be excluded from the vote and will have no effect on the outcome of the vote. |

If no specification is made, then the shares will be voted “FOR” the election as directors of the persons nominated by the board of directors, “FOR” Proposal 2, “FOR” Proposal 3, for once every THREE years with respect to Proposal 4, and otherwise in accordance with the recommendations of the board of directors.

Does the Company expect there to be any additional matters presented at the Meeting?

Other than the items of business described in this proxy statement, the Company is not aware of any other business to be acted upon at the Meeting. If you grant a proxy, the persons named as proxy holders, Mark W. Harding and Harrison H. Augur, have the discretion to vote your shares on any additional matter properly presented for a vote at the Meeting. If for any unforeseen reason any of the director nominees are not available for election at the date of the Meeting, the named proxy holders will vote your shares for such other candidates as may be nominated by the board.

When will the results of the voting being announced?

The Company will announce preliminary results at the Meeting and will publish final results in a current report on Form 8-K to be filed within four business days of the date of the Meeting.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND

MANAGEMENT AND RELATED SHAREHOLDER MATTERS

Voting Securities and Principal Holders Thereof

The following table sets forth information as of November 18, 2019, as to the beneficial ownership of shares of the Company’s common stock by (i) each person (or group of affiliated persons) known to the Company to own beneficially 5% or more of the common stock, (ii) each director of the Company and each nominee for director, (iii) each executive officer, and (iv) all directors and executive officers as a group. All information is based on information filed by such persons with the SEC and other information provided by such persons to the Company. Except as otherwise indicated, the Company believes that each of the beneficial owners listed has sole investment and voting power with respect to such shares. On November 18, 2019, there were 23,826,598 common shares outstanding. Shares not outstanding but deemed beneficially owned by virtue of the right of a person to acquire shares within 60 days of November 18, 2019, are included as outstanding and beneficially owned for that person but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Name and address of beneficial owner |

Amount and nature of beneficial ownership |

Percent of class |

||||

Mark W. Harding** |

927,244 | (1) |

3.86 | % |

||

Harrison H. Augur** |

166,281 | (2) |

* |

|||

Patrick J. Beirne** |

29,500 | (3) |

* |

|||

Arthur G. Epker III** |

58,000 | (4) |

* |

|||

Richard L. Guido** |

58,000 | (5) |

* |

|||

Peter C. Howell** |

58,500 | (6) |

* |

|||

All officers and directors as a group (6 persons) |

1,297,525 | (7) |

5.35 | % |

||

PAR Capital Management, Inc. / PAR Investment Partners, L.P. / PAR Group II, L.P. |

3,032,970 | (8) |

12.73 | % |

||

Plaisance Capital LLC / Plaisance SPV I, LLC / Daniel Kozlowski 250 Fillmore Street, Suite 525, Denver, CO 80206 |

3,754,609 | (9) |

15.76 | |||

Trigran Investments, Inc. 630 Dundee Road, Suite 230, Northbrook, IL 60062 |

1,806,463 | (10) |

7.58 | % |

||

| * | Less than 1% |

| ** | Address is the Company’s address: 34501 E. Quincy Avenue, Bldg. 34, Box 10, Watkins, CO 80137 |

| (1) | Includes 200,001 shares purchasable by Mr. Harding under options exercisable within 60 days. Includes 210,000 shares of common stock held by SMA Investments, LLLP, a limited liability limited partnership controlled by Mr. Harding. |

| (2) | Includes 53,000 shares purchasable by Mr. Augur under options exercisable within 60 days. Includes 10,000 shares of common stock held by Patience Partners, LLC, a limited liability company in which a foundation controlled by Mr. Augur is a 60% member and Mr. Augur is a 20% managing member. Includes 46,111 shares of common stock held in a margin account owned by Auginco, a Colorado general partnership, which is owned 50% by Mr. Augur and 50% by his wife. |

| (3) | Includes 29,500 shares purchasable by Mr. Beirne under options exercisable within 60 days. |

| (4) | Includes 53,000 shares purchasable by Mr. Epker under options exercisable within 60 days. |

| (5) | Includes 53,000 shares purchasable by Mr. Guido under options exercisable within 60 days. |

| (6) | Includes 50,500 shares purchasable by Mr. Howell under options exercisable within 60 days. |

| (7) | Includes the following shares: |

| a. | 210,000 shares held by SMA Investments, LLLP as described in number 1 above, |

| b. | 439,001 shares purchasable by directors and officers under options exercisable within 60 days, and |

| c. | 10,000 shares of common stock held by Patience Partners, LLC, and 46,111 shares of common stock held by Auginco, as described in number 2 above. |

| (8) | PAR Investment Partners, L.P. (“PIP”) owns directly 3,032,970 shares. PAR Group II, L.P. (“PGII”), through its control of PIP as general partner, has sole voting and dispositive power with respect to all 3,032,970 shares owned beneficially by PIP. PAR Capital Management, Inc., through its control of PGII as general partner, has sole voting and dispositive power with respect to all 3,032,970 shares owned beneficially by PIP. |

| (9) | This disclosure is based on the Schedule 13D filed by Plaisance Capital LLC (“PCL”), Plaisance SPV I, LLC (“PSPV”), and Daniel Kozlowski on October 15, 2019. It includes 3,754,609 shares of common stock owned by PCL. Daniel Kozlowski, as managing member of PCL, may be considered the beneficial owner of shares beneficially owned by PCL. PSVP, through PCL as its investment manager, may be considered the beneficial owner of 2,684,097 shares owned by PCL. |

| (10) | This disclosure is based on a Schedule 13G/A filed by Trigran Investments, Inc. (“TII”), Douglas Granat, Lawrence A. Oberman, Steven G. Simon, Bradley F. Simon and Steven R. Monieson on February 14, 2019. It includes 1,806,463 shares of common stock owned by TII. By reason of their roles as controlling shareholders and/or sole directors of TII, each of Douglas Granat, Lawrence A. Oberman, Steven G. Simon, Bradley F. Simon and Steven R. Monieson may be considered the beneficial owners of shares beneficially owned by TII. |

4

Securities Authorized for Issuance Under Equity Compensation Plans

The following table sets forth certain information regarding the Company’s equity compensation plans as of August 31, 2019. All securities outstanding represent options to purchase common stock.

Plan category |

Number of securities to be issued upon exercise of outstanding options (a) |

Weighted-average exercise price of outstanding options (b) |

Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (c) |

||||||

Equity compensation plans: |

|||||||||

Approved by security holders |

555,500 | $ | 6.33 | 1,230,500 | |||||

Not approved by security holders |

— | — | — | ||||||

Total |

555,500 | $ | 6.33 | 1,230,500 | |||||

DIRECTORS AND EXECUTIVE OFFICERS

The following table sets forth the Company’s directors, director nominees, and executive officer and their positions currently held with the Company.

|

Name

|

Age

|

Position

|

|

Harrison H. Augur

|

77

|

Chairman of the Board*

|

|

Patrick J. Beirne

|

56

|

Director*

|

|

Arthur G. Epker, III

|

57

|

Director*

|

|

Richard L. Guido

|

75

|

Director*

|

|

Mark W. Harding

|

56

|

Director, President, CEO and CFO*

|

|

Peter C. Howell

|

70

|

Director*

|

| * | Director nominee |

The principal occupation and other information about each of the individuals listed above, including the period during which each has served as director or officer, can be found beginning on page 14.

5

CORPORATE GOVERNANCE AND BOARD MATTERS

Board Leadership Structure

The Company’s board of directors has chosen to separate the positions of Chief Executive Officer (“CEO”) and Chairman of the Board. Keeping these positions separate allows the Company’s CEO to focus on developing and implementing the Company’s business plans and supervising the Company’s day-to-day operations and allows the Company’s Chairman to lead the board of directors in its oversight and advisory roles. Because of the many responsibilities of the board of directors and the significant time and effort required by each of the Chairman and the CEO to perform their respective duties, the Company believes that having separate persons in these roles enhances the ability of each to discharge those duties effectively and, as a corollary, enhances the Company’s prospects for success. The board of directors also believes that having separate positions provides a clear delineation of responsibilities for each position and fosters greater accountability of management.

Board Risk and Oversight

Our board of directors, as a whole and through its committees, has responsibility for the oversight of risk management. With the oversight of the Company’s full board of directors, the Company’s CEO is responsible for the day-to-day management of the material risks the Company faces. In its oversight role, the board of directors has the responsibility to satisfy itself that the risk management processes designed and implemented by management are adequate and functioning as designed. At least annually, the board of directors holds a strategic planning session with management to discuss strategies, key challenges, risks and opportunities for the Company. This involvement of the board of directors in setting the Company’s business strategy is a key part of its oversight of risk management, its assessment of management’s appetite for risk, and its determination of what constitutes an appropriate level of risk for the Company. Additionally, the board of directors regularly receives updates from management regarding certain risks that the Company faces, including various operating risks. Management attends meetings of the board of directors and its committees on a regular basis, and as is otherwise needed, and is available to address any questions or concerns raised by the board on risk management and any other matters.

The Audit Committee is responsible for overseeing risk management of financial matters, financial reporting, the adequacy of the Company’s risk-related internal controls, internal investigations, and enterprise risks, generally. The Nominating and Corporate Governance Committee (the “Nominating Committee”) oversees the Company’s Corporate Governance Guidelines and governance-related risks, such as board independence, as well as management and director succession planning. The Compensation Committee oversees risks related to compensation policies and practices and is responsible for establishing and maintaining compensation policies and programs designed to create incentives consistent with the Company’s business strategy that do not encourage excessive risk-taking.

Board Membership and Director Independence

Director Independence – At least a majority of the members of the board and all members of the board’s Audit, Compensation, and Nominating Committees must be independent in accordance with the listing standards of The NASDAQ Stock Market. The board has determined that four of the six current members, Messrs. Augur, Epker, Guido, and Howell, are independent pursuant to the standards of The NASDAQ Stock Market.

Terms of Directors and Officers – All directors are elected for one-year terms which expire at the annual meeting of shareholders or when their successors are duly elected and qualified. The Company’s officers are elected annually by the board of directors and hold office until their successors are duly elected and qualified.

Family Relationships of Directors and Officers – None of the current directors or officers, or nominees for director, is related to any other officer or director of the Company or to any nominee for director.

Board Meetings Held – The board of directors and each of the standing committees described below meet throughout the fiscal year on a set schedule. They also hold special meetings and act by written consent from time to time as appropriate. The Company’s independent directors meet regularly in executive sessions without management present. Generally, the executive sessions of independent directors are held in conjunction with each regularly scheduled board meeting.

6

During the fiscal year ended August 31, 2019, the board of directors held six (6) meetings. All board members attended 75% or more of the aggregate of the total number of meetings of the board of directors and the total number of meetings held by all committees of the board on which the director served during the periods that the director served on the board and committees, as applicable. All of the Company’s board members are expected to attend the annual meeting of shareholders. All of the Company’s board members attended the 2019 annual meeting of shareholders.

Committees

The Board has three standing committees: the Audit Committee, Compensation Committee and Nominating Committee. Each of the committees regularly reports on its activities and actions to the full board of directors.

Membership in the standing committees for fiscal 2019 is set forth below:

|

Fiscal 2019 Committee Membership

|

|||

|

Director

|

Audit

Committee |

Compensation

Committee |

Nominating

Committee |

|

H. Augur

|

X

|

X

|

X

|

|

P. Beirne

|

—

|

—

|

—

|

|

A. Epker

|

—

|

Chair

|

X

|

|

R. Guido

|

X

|

X

|

Chair

|

|

M. Harding

|

—

|

—

|

—

|

|

P. Howell

|

Chair

|

—

|

—

|

Audit Committee – The Audit Committee consists of Mr. Howell (Chairman) and Messrs. Augur and Guido. The board of directors has determined that all of the members of the Audit Committee are “independent” within the meaning of the listing standards of The NASDAQ Stock Market and the SEC rules governing audit committees. In addition, the board has determined that Mr. Howell meets the SEC criteria of an “audit committee financial expert” by reason of his understanding of Accounting Principles Generally Accepted in the United States of America (“GAAP”) and the application of GAAP, his education, his experiences as an auditor and chief financial officer, and his understanding of financial statements. See Mr. Howell’s biography under Election of Directors (Proposal No. 1) for additional information. The functions to be performed by the Audit Committee include the appointment, retention, compensation and oversight of the Company’s independent auditors, including pre-approval of all audit and non-audit services to be performed by such auditors. The Audit Committee Charter is available on the Company’s website at www.purecyclewater.com. The Audit Committee held nine (9) meetings during the fiscal year ended August 31, 2019.

Compensation Committee – The Compensation Committee consists of Mr. Epker (Chairman) and Messrs. Augur and Guido. The board of directors determined that all members of the Compensation Committee were “independent” within the meaning of the listing standards of The NASDAQ Stock Market. The functions to be performed by the Compensation Committee include establishing the compensation of officers, evaluating the performance of officers and key employees, and administering employee incentive compensation plans. The Compensation Committee typically meets with the CEO to obtain information about employee performance and compensation recommendations. It also has the authority to engage outside advisors to assist the committee with its functions. The Compensation Committee has the power to delegate authority to the CEO or a subcommittee to make certain determinations with respect to compensation for employees who are not executive officers. The Company’s Compensation Committee Charter is available on the Company’s website at www.purecyclewater.com. The Compensation Committee held three (3) meetings during the fiscal year ended August 31, 2019.

Nominating and Corporate Governance Committee – The Nominating Committee consists of Messrs. Guido (Chairman), Augur and Epker. The board of directors determined that all members of the Nominating Committee were “independent” within the meaning of the listing standards of The NASDAQ Stock Market. The principal responsibilities of the Nominating Committee are to identify and nominate qualified individuals to serve as members of the board and to make recommendations to the board with respect to director compensation. In addition, the Nominating Committee is responsible for establishing the Company’s Corporate Governance Guidelines and evaluating the board and its processes. In selecting nominees for the board, the Nominating Committee is seeking a board with a variety of experience and expertise, and in selecting nominees it will consider business experience in the industry in which the Company operates, financial expertise, independence from the Company, experience with publicly traded companies, experience with relevant regulatory matters in which the Company is involved, and a

7

reputation for integrity and professionalism. The Company does not have a formal policy with respect to the consideration of diversity in identifying director nominees, but it considers diversity as part of its overall assessment of the board’s functions and needs. Nominees must be at least 21 years of age and less than 75 on the date of the annual meeting of shareholders unless the Nominating Committee waives such requirements. Identification of prospective board members is done by a combination of methods, including word-of-mouth in industry circles, inquiries of outside professionals and recommendations made to the Company. The Nominating Committee Charter is available on the Company’s website at www.purecyclewater.com. The Nominating Committee held three (3) meetings during the fiscal year ended August 31, 2019.

The Nominating Committee will consider nominations for director made by shareholders of record entitled to vote. In order to make a nomination for election at the January 2021 annual meeting, a shareholder must provide notice, along with supporting information (discussed below) regarding such nominee, to the Company’s Secretary by August 7, 2020, but not before June 8, 2020, in accordance with the Company’s bylaws. The Nominating Committee evaluates nominees recommended by shareholders utilizing the same criteria it uses for other nominees. Each shareholder recommendation should be accompanied by the following:

| • | The full name, address, and telephone number of the person making the recommendation, and a statement that the person making the recommendation is a shareholder of record (or, if the person is a beneficial owner of the Company’s shares but not a record holder, a statement from the record holder of the shares verifying the number of shares beneficially owned), and a statement as to whether the person making the recommendation has a good faith intention to continue to hold those shares through the date of the Company’s next annual meeting of shareholders; |

| • | The full name, address, and telephone number of the candidate being recommended, information regarding the candidate’s beneficial ownership of the Company’s equity securities, any business or personal relationship between the candidate and the person making the recommendation, and an explanation of the value or benefit the person making the recommendation believes the candidate would provide as a director; |

| • | A statement signed by the candidate that he or she is aware of and consents to being recommended to the Nominating Committee and will provide such information as the Nominating Committee may request for its evaluation of candidates; |

| • | A description of the candidate’s current principal occupation, business or professional experience, previous employment history, educational background, and any areas of particular expertise; |

| • | Information about any business or personal relationships between the candidate and any of the Company’s customers, suppliers, vendors, competitors, directors or officers, or other persons with any special interest regarding any transactions between the candidate and the Company; and |

| • | Any information in addition to the above about the candidate that would be required to be included in the Company’s proxy statement (including without limitation information about legal proceedings in which the candidate has been involved within the past ten years). |

Code of Business Conduct and Ethics

The Company has adopted a Code of Business Conduct and Ethics for its directors, officers and employees, which is available on the Company’s website at www.purecyclewater.com.

Shareholder Communications with the Board

The board of directors has adopted a policy for shareholders to send communications to the board. The policy is available on the Company’s website. Shareholders wishing to send communications to the board may contact the Chairman of the board at the Company’s principal place of business or email chairman@purecyclewater.com. All such communications shall be shared with the members of the board, or if applicable, a specified committee or director.

Director Compensation

Directors who are employees of the Company receive no fees for board service. Currently, Mr. Harding is the only director who is also an employee. Each non-employee director receives a payment of $12,000 for each full year in which he or she serves as a director, with an additional payment of $3,500 for serving as chairman of a committee,

8

$1,000 for each committee on which he or she serves as a member but not as chairman, and $1,000 for serving as chairman of the board. Each director receives $1,000 for attendance at each board meeting and, if committee meetings are held separately from board meetings, each director receives $1,000 for attendance at such committee meetings.

The following table sets forth summary information concerning the compensation paid to the Company’s non-employee directors in fiscal 2019 for services to the Company:

Director Compensation |

|||||||||

Name |

Fees Earned or Paid in Cash ($) |

Option Awards(1) ($) |

Total ($) |

||||||

H. Augur(2) |

26,000 | 25,348 | 51,348 | ||||||

P. Beirne(3) |

18,000 | 25,348 | 43,348 | ||||||

A. Epker(4) |

22,500 | 25,348 | 47,848 | ||||||

R. Guido(5) |

27,500 | 25,348 | 52,848 | ||||||

P. Howell(6) |

25,500 | 25,348 | 50,848 | ||||||

| (1) | In addition to cash compensation, pursuant to the Pure Cycle Corporation 2014 Equity Incentive Plan effective as of April 12, 2014 (the “2014 Plan”), each non-employee director may receive an option to purchase shares of common stock at the discretion of the board, and the terms of such awards granted to non-employee directors, including the discretion to adopt one or more formulas for the determination of non-employee director awards, are at the discretion of the board. On January 14, 2015, the board adopted a formula under the 2014 Plan that provides for an option grant to each non-employee director to purchase 6,500 shares of common stock at each annual meeting of shareholders at which the non-employee director is re-elected to the board. The options vest on the date of the next annual meeting of shareholders or the first anniversary of the date of grant, whichever is earlier. On January 27, 2016, the board adopted a formula under the 2014 Plan providing for an option grant to each non-employee director to purchase 10,000 shares of common stock upon initial election or appointment to the board, which vests one-half on each of the first two anniversary dates of the grant. The option exercise price for all non-employee director grants is set at the fair market value of the common stock on the date of the grant. The amounts in this column represent the aggregate grant date fair value of options granted during the Company’s fiscal year ended August 31, 2019, as computed in accordance with FASB ASC Topic 718. For more information about how the Company values and accounts for share-based compensation see Note 8 – Shareholders’ Equity to the Company’s audited consolidated financial statements for the year ended August 31, 2019, which are included in the Company’s 2019 Annual Report on Form 10-K. |

| (2) | The $26,000 earned by Mr. Augur is comprised of $12,000 for serving on the board, $1,000 for being chairman of the board, $3,000 for serving on three committees, and $10,000 for attendance at board and committee meetings. Mr. Augur had options outstanding to purchase 53,000 shares of common stock as of August 31, 2019, all of which are exercisable within 60 days of the filing of this proxy statement. |

| (3) | The $18,000 earned by Mr. Beirne is comprised of $12,000 for serving on the board and $6,000 for attendance at board meetings. Mr. Beirne had options outstanding to purchase 29,500 shares of common stock as of August 31, 2019, all of which are exercisable within 60 days of the filing of this proxy statement. |

| (4) | The $22,500 earned by Mr. Epker is comprised of $12,000 for serving on the board, $3,500 for serving as chairman of the Compensation Committee, $1,000 for serving on one additional committee, and $6,000 for attendance at board and committee meetings. Mr. Epker had options outstanding to purchase 53,000 shares of common stock as of August 31, 2019, all of which are exercisable within 60 days of the filing of this proxy statement. |

| (5) | The $27,500 earned by Mr. Guido is comprised of $12,000 for serving on the board, $3,500 for serving as chairman of the Nominating Committee, $2,000 for serving on two additional committees, and $10,000 for attendance at board and committee meetings. Mr. Guido had options outstanding to purchase 53,000 shares of common stock as of August 31, 2019, all of which are exercisable within 60 days of the filing of this proxy statement. |

| (6) | The $25,500 earned by Mr. Howell is comprised of $12,000 for serving on the board, $3,500 for serving as chairman of the Audit Committee, and $10,000 for attendance at board and committee meetings. Mr. Howell had options outstanding to purchase 50,500 shares of common stock as of August 31, 2019, all of which are exercisable within 60 days of the filing of this proxy statement. |

9

Executive Compensation Discussion

Person Covered

This discussion addresses compensation for fiscal 2019 for Mark W. Harding, the Company’s President, CEO and Chief Financial Officer (“CFO”) and its only executive officer.

Compensation Philosophy

The Company’s executive compensation program is administered by the Compensation Committee of the board of directors. The Compensation Committee reviews the performance and compensation level for the CEO and makes recommendations to the board of directors for final approval. The Compensation Committee also determines equity grants under the 2014 Plan, if any. The CEO may provide information to the Compensation Committee regarding his compensation; however, the Compensation Committee makes the final determination on the executive compensation recommendation to the board. Final compensation determinations are generally made in September immediately following the end of the Company’s fiscal year. The following outlines the philosophy and objectives of the Company’s compensation plan.

The objectives of the Company’s compensation plan are to correlate executive compensation with the Company’s objectives and overall performance and to enable the Company to attract, retain and reward executive officers who contribute to its long-term growth and success. The compensation plan is designed to create a mutuality of interest between executive and shareholders through equity ownership programs and to focus the executive’s attention on overall corporate objectives, in addition to the executive’s personal objectives.

The goal of the Compensation Committee is to provide a compensation package that is competitive with compensation practices of companies with which the Company competes, provides variable compensation that is linked to achievement of the Company’s operational performance goals, and aligns the interests of the executive officer and employees with those of the shareholders of the Company. Additionally, the Compensation Committee’s goal is to design a compensation package that falls within the mid-range of the packages provided to executives of similarly sized corporations in like industries.

Generally, the executive officer receives a base salary and an opportunity to earn a cash bonus based on attainment of predetermined objectives at the discretion of the Compensation Committee. Long-term equity incentives are also considered. The mixture of cash and non-cash compensation items is designed to provide the executive with a competitive total compensation package while not using an excessive amount of the Company’s cash or overly diluting the equity positions of its shareholders. The Company’s executive officer does not receive any perquisites or personal benefits. The executive officer is eligible for the same benefits available to all Company employees. Currently, this includes participation in a tax-qualified 401(k) plan and health and dental plans.

Compensation Consultants

The Compensation Committee charter authorizes the Compensation Committee to engage compensation consultants and other advisors to assist it with its duties. No compensation consultants were engaged by either management or the Compensation Committee during fiscal 2019.

Shareholder Feedback and Say-On-Pay Results

The Compensation Committee considers the outcome of shareholder advisory votes on executive compensation when making future decisions relating to the compensation of the CEO and the Company’s executive compensation program. At the 2019 annual meeting of shareholders, approximately 99.4% of the votes cast were for approval of the “say-on-pay” proposal. The Compensation Committee believes the results conveyed support for continuing with the philosophy, strategy and objectives of the Company’s executive compensation program.

Compensation of the Company’s CEO

The current compensation program for the Company’s CEO consists of the following:

Base Salary – Base salary is intended to provide the CEO with basic non-variable compensation that is competitive considering the CEO’s responsibilities, experience and performance and the Company’s financial resources.

10

In making the base salary decision, the Compensation Committee exercised its discretion and judgment primarily based upon individual performance and competitive considerations. In September 2018, the Compensation Committee recommended, and the board of directors approved, a salary increase for Mr. Harding from $400,000 to $425,000 for fiscal 2019. In recognition of Mr. Harding’s continuing contributions in 2019 in positioning the Company to realize its long-term objectives, the Compensation Committee recommended, and the board approved, raising Mr. Harding’s base salary to $450,000 for fiscal 2020. At the same time, Mr. Harding was awarded the incentive bonus discussed below in recognition of the significant accomplishments of Mr. Harding and the Company in achieving the objectives set forth in the Company’s 2019 performance plan.

Incentive Bonus – The Compensation Committee’s goal in granting incentive bonuses is to tie a portion of the CEO’s compensation to the operating performance of the Company and to the CEO’s individual contribution to the Company. In formulating recommendations for bonus compensation for Mr. Harding, the Compensation Committee considered a number of factors, including, among other things, (i) the efforts of Mr. Harding in pursuing projects to achieve long-term goals of the Company; (ii) the progress made by Mr. Harding and the Company in achieving the objectives established by the Compensation Committee for fiscal 2019 (as discussed below); and (iii) Mr. Harding’s experience, talents and skills and the importance thereof to the Company.

In September 2018, the Compensation Committee recommended, and the board approved, a performance plan for fiscal 2019, which was comprised of financial and nonfinancial objectives, both short-term and long-term in nature, including objectives related to developing a long-term strategic plan for the Company, development of the Company’s Sky Ranch property, improving monthly financial reporting and tracking of project costs, managing the budget, and recruiting additional personnel. The plan also included strategic objectives, the disclosure of which the Company believes would cause competitive harm.

In September 2019, the Compensation Committee reviewed the Company’s operating results for fiscal 2019 and evaluated the Company’s success in achieving the performance plan objectives. The Compensation Committee determined that a bonus was warranted in recognition of Mr. Harding’s continued success regarding the Sky Ranch development, in particular delivering and closing 255 lots ahead of schedule and completing wet utilities to all 506 lots in the first phase of the Sky Ranch development ahead of schedule. In addition, Mr. Harding successfully managed expenses of the Company consistent with the budget and achieved operating revenues in excess of budgeted revenue. The Compensation Committee recommended awarding, and the board authorized awarding, Mr. Harding a discretionary bonus of $350,000 in fiscal 2019, as well as a stock option to purchase 50,000 shares of common stock, as described below.

Long-Term Equity Incentives – The goal of long-term equity incentive compensation is to align the interests of the CEO with those of the Company’s shareholders and to provide the CEO with a long-term incentive to manage the Company from the perspective of an owner with an equity stake in the business. It is the belief of the Compensation Committee that stock options and other equity-based awards directly motivate an executive to maximize long-term shareholder value. The philosophy of the Compensation Committee in administering the Company’s 2014 Plan is to tie the number of stock options and shares of stock awarded to each employee to the performance of the Company and to the individual contribution of each employee to the Company. The Compensation Committee recommended awarding, and the board authorized awarding, Mr. Harding a non-statutory stock option to purchase 50,000 shares of the Company’s common stock, as well as a discretionary bonus of $350,000, in recognition of his performance during the fiscal year ended August 31, 2019, and to motivate future performance, determining that it would be preferable to recognize his achievements with a mix of cash and long-term incentives.

Stock Ownership Requirements for Executive Officers

While the Company has not established stock ownership guidelines for its executive officer, at August 31, 2019, the Company’s CEO owned stock with a market value of approximately of eighteen times his base salary, which the Compensation Committee believes appropriately aligns the interests of the CEO with those of the Company’s shareholders.

Hedging Policy

Company policy prohibits directors, officers and employees from engaging in short sales of Company securities, buying or selling put or call options of Company securities, buying financial instruments designed to hedge or offset any decrease in the market value of the Company securities, or engaging in frequent trading (for example, daily or weekly) to take advantage of fluctuations in share price.

11

Employment and Severance Agreements

The Company does not have any written employment, change of control, severance or other similar agreement with the executive officer.

Executive Compensation Tables

The Company’s CEO, Mr. Harding, is the Principal Executive Officer and the Principal Financial Officer of the Company and its only executive officer. Therefore, all tables contained in this section relate solely to Mr. Harding.

Summary Compensation Table |

|||||||||||||

Name and Principal Position |

Fiscal Year |

Salary ($) |

Bonus ($) |

Option Awards(1) ($) |

Total ($) |

||||||||

Mark W. Harding |

2019 |

425,000 | 350,000 | 198,170 | (2) |

973,170 | |||||||

President, CEO and CFO |

2018 |

400,000 | 300,000 | 285,755 | (3) |

985,755 | |||||||

| (1) | The amounts in this column represent the aggregate grant date fair value of stock options awarded in fiscal 2020 and 2019 (for performance in fiscal 2019 and 2018, respectively) as computed in accordance with FASB ASC Topic 718. See Note 8 – Shareholders’ Equity to the Company’s audited consolidated financial statements for the year ended August 31, 2019, which are included in our 2019 Annual Report on Form 10-K for a description of the assumptions used to value option awards and the manner in which the Company recognizes the related expense pursuant to FASB ASC Topic 718. |

| (2) | The option award was granted and approved on September 27, 2019, with an exercise price equal to $10.35, the closing market price of the Company’s common stock on the date of grant. The option award vests in three equal installments on each of the first, second and third anniversary dates of the grant and will expire ten years from date of grant. |

| (3) | The option award was granted and approved on September 26, 2018, with an exercise price equal to $11.15, the closing market price of the Company’s common stock on the date of grant. The option award vests in three equal installments on each of the first, second and third anniversary dates of the grant and will expire ten years from date of grant. |

Outstanding Equity Awards at Fiscal Year-End – The following table summarizes certain information regarding outstanding option awards held by the named executive officer at August 31, 2019. There are no other types of equity awards outstanding.

Outstanding Equity Awards at Fiscal Year-End |

||||||||||||

Name |

Number of Securities Underlying Unexercised Options (#) Exercisable |

Number of Securities Underlying Unexercised Options (#) Unexercisable |

Option Exercise Price |

Option Expiration Date |

||||||||

Mark W. Harding |

100,000 | 0 | $ | 5.88 | 8/14/2023 | |||||||

Mark W. Harding |

33,334 | 16,666 | (1) |

$ | 5.61 | 10/12/2026 | ||||||

Mark W. Harding |

16,666 | 33,334 | (2) |

$ | 7.60 | 9/27/2027 | ||||||

Mark W. Harding |

0 | 50,000 | (3) |

$ | 11.15 | 9/26/2028 | ||||||

| (1) | One third of the total number of shares subject to the option vest on each of the first, second and third anniversary date of the grant date, October 12, 2016. |

| (2) | One third of the total number of shares subject to the option vest on each of the first, second and third anniversary date of the grant date, September 27, 2017. |

| (3) | One third of the total number of shares subject to the option vest on each of the first, second and third anniversary date of the grant date, September 26, 2018. |

12

REPORT OF THE AUDIT COMMITTEE1

The Audit Committee of the board of directors is comprised of independent directors and operates under a written charter adopted by the board of directors. The Audit Committee Charter is reassessed and updated as needed in accordance with applicable rules of the SEC and The NASDAQ Stock Market.

The Audit Committee serves in an oversight capacity. Management is responsible for the Company’s internal controls over financial reporting. The independent auditors are responsible for performing an independent audit of the Company’s financial statements in accordance with the standards of the Public Company Accounting Oversight Board (“PCAOB”) and issuing a report thereon. The Audit Committee’s primary responsibility is to monitor and oversee these processes and to select and retain the Company’s independent auditors. In fulfilling its oversight responsibilities, the Audit Committee reviewed with management the Company’s audited financial statements and discussed not only the acceptability but also the quality of the accounting principles, the reasonableness of the significant judgments and estimates, critical accounting policies and the clarity of disclosures in the audited financial statements prior to issuance.

The Audit Committee reviewed and discussed the audited financial statements as of and for the year ended August 31, 2019, with the Company’s independent auditors, Plante & Moran PLLC (“Plante Moran”), and discussed not only the acceptability but also the quality of the accounting principles, the reasonableness of the significant judgments and estimates, critical accounting policies and the clarity of disclosures in the audited financial statements prior to issuance. The Audit Committee discussed with Plante Moran the matters required to be discussed by the applicable requirements of the PCAOB and the SEC. The Audit Committee has received the written disclosures and the letter from Plante Moran required by the applicable requirements of the PCAOB regarding independent auditor communications with the Audit Committee concerning independence and has discussed Plante Moran’s independence with Plante Moran.

Based on the foregoing, the Audit Committee recommended to the board of directors that the Company’s audited financial statements be included in the Company’s Form 10-K for the fiscal year ended August 31, 2019.

/s/ Peter C. Howell (Chairman)

/s/ Harrison H. Augur

/s/ Richard L. Guido

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Agreements with Related Parties

It is the Company’s policy as set forth in its Code of Business Conduct and Ethics that actual or apparent conflicts of interest are to be avoided if possible and must be disclosed to the board of directors. Pursuant to the Code of Business Conduct and Ethics and the Audit Committee Charter, any transaction involving a related party must be reviewed and approved or disapproved by the Audit Committee. Additionally, the Audit Committee Charter requires the Audit Committee to review any transaction involving the Company and a related party at least once a year or upon any significant change in the transaction or relationship. The Code also provides non-exclusive examples of conduct which would involve a potential conflict of interest and requires any material transaction involving a potential conflict of interest to be approved in advance by the board. If a waiver from the Code is granted to an executive officer or director, the nature of the waiver will be disclosed on the Company’s website, in a press release, or on a current report on Form 8-K.

The Company annually requires each of its directors and executive officers to complete a directors’ and officers’ questionnaire that solicits information about related party transactions. The Company’s board of directors and outside legal counsel review all transactions and relationships disclosed in the directors’ and officers’ questionnaire, and the board makes a formal determination regarding each director’s independence. If a director is determined to be no longer independent, such director, if he or she serves on any of the Audit Committee, the Nominating Committee, or the Compensation Committee, will be removed from such committee prior to (or otherwise will not participate in) any future meeting of the committee. If the transaction presents a conflict of interest, the board of directors will determine the appropriate response.

| 1 | This report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference in any filing of the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934 (the “Exchange Act”), irrespective of any general incorporation language in any such filing, except to the extent the Company specifically references this report. |

13

ELECTION OF DIRECTORS

(Proposal No. 1)

The Company’s board of directors currently has six members. The board of directors nominates the following persons currently serving on the board for reelection to the board: Mark W. Harding, Harrison H. Augur, Patrick J. Beirne, Arthur G. Epker III, Richard L. Guido, and Peter C. Howell.

Set forth below are the names of all nominees for director, all positions and offices with the Company held by each such person, the period during which each has served as such, and the principal occupations and employment of and public company directorships held by such persons during at least the last five years, as well as additional information regarding the skills, knowledge and experience with respect to each nominee which has led the board of directors to conclude that each such nominee should be elected or re-elected as a director of the Company.

Mark W. Harding. Mr. Harding joined the Company in April 1990 as Corporate Secretary and Chief Financial Officer. He was appointed President of the Company in April 2001, CEO in April 2005, and a member of the board of directors in February 2004. Mr. Harding brings a background in investment banking and public finance, having worked from 1988 to 1990 for Price Waterhouse’s management consulting services where he assisted clients in public finance and other investment banking related services. Mr. Harding is the President and a board member of the Rangeview Metropolitan District, Sky Ranch Metropolitan District Nos. 1, 3, 4 and 5, and the Sky Ranch Community Authority Board and Vice President of the South Metro WISE Authority. Mr. Harding also serves on the board of directors of Hawaiian Macadamia Nut Orchards, L.P., which until June 2018 was a publicly traded limited partnership. In determining Mr. Harding’s qualifications to be on the board of directors, the board of directors considered, among other things, Mr. Harding’s extensive experience with the Company and his service on a number of advisory boards relating to water and wastewater issues in the Denver region, including a statewide roundtable created by the Colorado legislature charged with identifying ways in which Colorado can address the water shortages facing Front Range cities including Denver and Colorado Springs. Mr. Harding earned a B.S. Degree in Computer Science and a Master of Business Administration in Finance from the University of Denver.

Harrison H. Augur. Mr. Augur joined the board and was elected Chairman in April 2001. For more than 20 years, Mr. Augur has been involved with investment management and venture capital investment groups. Mr. Augur has been a managing member of Patience Partners, LLC since 1999. Mr. Augur received a Bachelor of Arts degree from Yale University, an LLB degree from Columbia University School of Law, and an LLM degree from New York University School of Law. In determining Mr. Augur’s qualifications to serve on the board of directors, the board of directors has considered, among other things, his extensive experience and expertise in finance and law.

Patrick J. Beirne. Mr. Beirne was appointed to the board in January 2016. Since April 2015, Mr. Beirne has been the Chairman and CEO of Nelson Infrastructure Services LLC, a private company 50% owned by Mr. Beirne (“Nelson Infrastructure”), and Nelson Pipeline Constructors LLC (“Nelson Pipeline”), a wholly-owned subsidiary of Nelson Infrastructure. In addition, he served as Chairman and CEO of Nelson Civil Construction Services LLC, a 90% subsidiary of Nelson Infrastructure, from its founding in December 2015 until the end of 2018, when Nelson Infrastructure Services was merged into Nelson Pipeline Constructors LLC. Mr. Beirne is the Chairman and CEO of Nelson Pipeline Constructors LLC. Nelson Pipeline is a utility contractor specializing in the construction of underground sewer, water and storm sewer pipelines. Prior to working at Nelson Pipeline, Mr. Beirne worked at Pulte Group, Inc. for 29 years in various management roles, where he gained extensive experience in the home building industry. In his last position with Pulte Group, Inc., from January 2008 to September 2014, he served as Central Area President where he helped create the strategy for the firm’s long-term vision and oversaw operations in 10 states. Mr. Beirne earned a B.S. degree from Michigan State University, is a Licensed General Contractor (Florida), and is active in many community and charitable organizations. In determining Mr. Beirne’s qualifications to serve on the board of directors, the board has considered, among other things, his extensive experience and expertise in the home building industry and in construction of water and sewer pipelines.

Arthur G. Epker III. Mr. Epker was appointed to the board in August 2007. Mr. Epker served as a Vice President of PAR Capital Management, Inc., the investment advisor to PAR Investment Partners, L.P., from 1992 through 2018 and as a director of PAR Capital Management, Inc., from 2007 through 2018. In that capacity, Mr. Epker managed a portion of the assets of PAR Investment Partners, L.P., a private investment fund and shareholder of the Company. Mr. Epker received his undergraduate degree in computer science and economics with highest distinction from the University of Michigan and received a Master of Business Administration from Harvard Business School. In determining Mr. Epker’s qualifications to serve on the board of directors, the board of directors has considered, among other things, his extensive experience and expertise in finance and investment management.

14

Richard L. Guido. Mr. Guido served as a member of the Company’s board from July 1996 through August 31, 2003, and rejoined the board in 2004. Mr. Guido was Associate General Counsel of DeltaCom, Inc., a telecommunications company, from March 2006 to March 2007. From 1980 through 2004, Mr. Guido was an employee of Inco Limited, a Canadian mining company listed on the NYSE (now known as Vale). While at Inco Mr. Guido served as Associate General Counsel of Inco Limited and served as President, Chief Legal Officer and Secretary of Inco United States, Inc., now known as Vale Americas, Inc. Mr. Guido received a Bachelor of Science degree from the United States Air Force Academy, a Master of Arts degree from Georgetown University, and a Juris Doctor degree from the Catholic University of America. In determining Mr. Guido’s qualifications to serve on the board of directors, the board of directors has considered, among other things, his extensive experience and expertise in finance, law and natural resource development.

Peter C. Howell. Mr. Howell was appointed to fill a vacancy on the board in February 2005. From 1997 to 2017, Mr. Howell served as an officer, director or advisor to various business enterprises in the area of acquisitions, marketing and financial reporting. From August 1994 to August 1997, Mr. Howell served as the Chairman and Chief Executive Officer of Signature Brands USA, Inc. (formerly known as Health-O-Meter), and from 1989 to 1994 Mr. Howell served as Chief Executive Officer and a director of Mr. Coffee, Inc. Mr. Howell is a member of the board of directors of Great Lakes Cheese, Inc., a privately held company. Mr. Howell served as a member of the board of directors of Libbey Inc. (NYSE:LBY) for over 20 years before resigning in 2016. Mr. Howell also spent 10 years as an auditor for Arthur Young & Co. (now Ernst & Young). Mr. Howell received a Master of Arts degree in Economics from Cambridge University. In determining Mr. Howell’s qualifications to serve on the board of directors, the board of directors has considered, among other things, his extensive experience and expertise in finance and financial reporting qualifying him as an audit committee financial expert as well as his general business expertise.

The proxy cannot be voted for more than the six nominees named. Directors are elected for one-year terms or until the next annual meeting of the shareholders and until their successors are elected and qualified. All of the nominees have expressed their willingness to serve, but if because of circumstances not contemplated, one or more nominees is not available for election, the proxy holders named in the enclosed proxy card intend to vote for such other person or persons as the Nominating Committee may nominate.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE ELECTION AS DIRECTORS OF THE PERSONS NOMINATED.

15

RATIFICATION OF APPOINTMENT OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

(Proposal No. 2)

Action is to be taken by the shareholders at the Meeting with respect to the ratification and approval of the selection by the Audit Committee of the Company’s board of directors of Plante & Moran PLLC (“Plante Moran”) to be the independent registered public accounting firm of the Company for the fiscal year ending August 31, 2020. In the event of a negative vote on such ratification, the Audit Committee of the board of directors will reconsider its selection. A representative of Plante Moran is expected to be present at the Meeting. The Plante Moran representative will have the opportunity to make a statement if he or she desires to do so and is expected to be available to respond to appropriate questions.

The Audit Committee reviews and approves in advance the audit scope, the types of non-audit services, if any, and the estimated fees for each category for the coming year. For each category of proposed service, Plante Moran is required to confirm that the provision of such services does not impair the auditors’ independence. Before selecting Plante Moran, the Audit Committee carefully considered that firm’s qualifications as an independent registered public accounting firm for the Company. This included a review of its reputation for integrity and competence in the fields of accounting and auditing. The Audit Committee has expressed its satisfaction with Plante Moran in all of these respects. The Audit Committee’s review included inquiry concerning any litigation involving Plante Moran and any proceedings by the SEC against the firm.

Plante Moran has no direct or indirect financial interest in the Company and does not have any connection with the Company in the capacity of promoter, underwriter, voting trustee, director, officer or employee. Neither the Company, nor any officer, director nor associate of the Company has any interest in Plante Moran.

Change in Auditors for Fiscal 2018 – As discussed in our Current Report on Form 8-K filed with the SEC on October 4, 2018, EKS&H LLLP (“EKS&H”) resigned as our independent registered public accounting firm on October 1, 2018 because EKS&H combined with Plante Moran. On October 1, 2018, the Audit Committee of our board of directors engaged Plante Moran to serve as the independent registered public accounting firm for the Company effective as of that date. EKS&H had been the Company’s independent registered public accounting firm since December 4, 2017.

During the period from December 4, 2017 to August 31, 2018, and the subsequent interim period through October 1, 2018, we did not have any disagreements with EKS&H on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to EKS&H’s satisfaction, would have caused EKS&H to make reference thereto in its reports on our financial statements for the relevant periods. During the period from December 4, 2017 to August 31, 2018, and the subsequent interim period through October 1, 2018, there were no reportable events, as defined in Item 304(a)(1)(v) of Regulation S-K.

During the fiscal years ended August 31, 2017 and 2018, and the subsequent interim period through October 1, 2018, the Company did not consult with Plante Moran regarding (i) the application of accounting principles to a specified transaction, either completed or proposed, or the type of audit opinion that might be rendered on the Company’s financial statements by Plante Moran, in either case where written or oral advice provided by Plante Moran would be an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue; or (ii) any other matter that was the subject of a disagreement between the Company and its former auditor or was a reportable event (as described in Item 304(a)(1)(iv) or Item 304(a)(1)(v) of Regulation S-K, respectively).

Change in Auditors for Fiscal 2018 – On December 4, 2017, the Audit Committee engaged EKS&H to serve as the independent registered public accounting firm of the Company beginning with the fiscal year ending August 31, 2018. EKS&H replaced Crowe Horwath LLP (now known as Crowe LLP) (“Crowe”) as the Company’s independent registered public accounting firm. Crowe, which served as the independent auditors for the fiscal year ended August 31, 2017, was dismissed on December 4, 2017.

The report of Crowe on the Company’s financial statements for the fiscal year ended August 31, 2017, did not contain an adverse opinion or disclaimer of opinion and such report was not qualified or modified as to uncertainty, audit scope, or accounting principles.

16

During the fiscal year ended August 31, 2017, and the subsequent interim period through December 4, 2017 (the date of the change in auditors), the Company did not have any disagreements with Crowe on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure, which disagreements, if not resolved to Crowe’s satisfaction, would have caused it to make reference thereto in its reports on the Company’s financial statements for the relevant periods. During the fiscal year ended August 2017, and the subsequent interim period through December 4, 2017, there were no reportable events, as defined in Item 304(a)(1)(v) of Regulation S-K.

During the fiscal years ended August 31, 2017 and 2016, and the subsequent interim period through December 4, 2017, the Company did not consult with EKS&H regarding (a) the application of accounting principles to a specified transaction, (b) the type of audit opinion that might be rendered on the Company’s financial statements by EKS&H, in either case where written or oral advice provided by EKS&H would be an important factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issues or (c) any other matter that was the subject of a disagreement between the Company and its former auditors or was a reportable event (as described in Item 304(a)(1)(iv) or Item 304(a)(1)(v) of Regulation S-K, respectively).

Fees –The following table sets forth the aggregate fees the Company was billed by Plante Moran and EKS&H for the fiscal years ended August 31, 2018 and 2019. 100% of the services in the table below were pre-approved by the Audit Committee in accordance with the Audit Committee Charter.

For the Fiscal Years Ended |

||||||

August 31, 2019 |

August 31, 2018 |

|||||

Audit Fees(1) |

$ | 110,000 | $ | 105,000 | ||

Audit-Related Fees |

$ | — | $ | — | ||

Tax Fees(2) |

$ | 6,500 | $ | — | ||

All Other Fees |

$ | — | $ | — | ||

Total |

$ | 116,500 | $ | 105,000 | ||

| (1) | Includes fees for the audit of the Company’s annual financial statements, the reviews of the Company’s quarterly financial statements and consents and other services normally provided by the independent auditors in connection with statutory and regulatory filings or engagements for those fiscal years, regardless of when the fees were billed or services were rendered. |

| (2) | The tax fees consist entirely of fees for the preparation of the federal and state corporate tax returns. |

Pre-Approval Policy – The Audit Committee has established a pre-approval policy in its charter. In accordance with the policy, the Audit Committee pre-approves all audit, non-audit and internal control related services provided by the independent auditors prior to the engagement of the independent auditors with respect to such services.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF THE INDEPENDENT AUDITORS.

17

ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Proposal No. 3)

The following proposal provides our shareholders with the opportunity to vote to approve or not approve, on an advisory basis, the compensation of our named executive officer as disclosed in the proxy statement in accordance with the compensation disclosure rules of the SEC.

We urge shareholders to read the “Executive Compensation” section beginning on page 10 of this proxy statement, as well as the Summary Compensation Table and other related compensation tables and narrative, beginning on page 12 of the proxy statement, which provide detailed information on the compensation of our named executive officer. The Company’s compensation programs are designed to support its business goals and promote short- and long-term profitable growth of the Company.

We are asking shareholders to approve the following advisory resolution at the Meeting:

RESOLVED, that the shareholders of the Company approve, on an advisory basis, the compensation of the Company’s named executive officer, as disclosed pursuant to Item 402 of Regulation S-K, including the disclosure under the heading “Executive Compensation” and in the compensation tables and accompanying narrative discussion in the Company’s Definitive Proxy Statement.

This advisory resolution, commonly referred to as a “say-on-pay” resolution, is not binding on the Company or the board of directors. The say-on-pay proposal is not intended to address any specific item of compensation but rather the overall compensation of our named executive officer and the executive compensation policies, practices, and plans described in this proxy statement. Although this proposal is non-binding, the board of directors will carefully review and consider the voting results when making future decisions regarding the Company’s executive compensation program. Based on the advisory vote of the shareholders at the annual meeting of shareholders held in January 2014, the board of directors determined that it would conduct an advisory vote on executive compensation on an annual basis. Notwithstanding the foregoing, the board of directors may decide to conduct advisory votes on a more or less frequent basis and may vary its practice based on factors such as the results of the vote on Proposal No. 4 (described below), discussions with shareholders and the adoption of material changes to compensation programs.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE COMPANY’S NAMED EXECUTIVE OFFICER.

18

FREQUENCY OF ADVISORY VOTE ON EXECUTIVE COMPENSATION

(Proposal No. 4)

The Dodd-Frank Act provides that shareholders must be given the opportunity to vote, on a non-binding, advisory basis, at least once every six years for their preference as to how frequently we should seek advisory votes on the compensation of our named executive officer as disclosed in accordance with the compensation disclosure rules of the SEC. By voting with respect to this Proposal 4, shareholders may indicate whether they would prefer that we conduct advisory votes on executive compensation every one, two, or three years. Shareholders also may, if they desire, abstain from casting a vote on this proposal.