| Earnings Presentation PURE CYCLE CORPORATION For the Three and Nine Months Ended May 31, 2025 Presented by Mark Harding www.purecyclewater.com Exhibit 99.2 ,-- |

| Statements that are not historical facts contained or incorporated by reference in this presentation are “forward-looking statements” (“FLS”) within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933 and Section 21C of the Securities Exchange Act of 1934 as amended. FLS involve risks and uncertainties that could cause actual results to differ from projected results. The words “anticipate,” “believe,” “estimate,” “expect,” “plan,” “intend” and similar expressions, as they relate to us, are intended to identify FLS. Such statements reflect our current views with respect to future events and are subject to certain risks, uncertainties and assumptions. We are not able to predict all factors that may affect future results. We cannot assure you that any of our expectations will be realized. Our actual results could differ materially from those discussed in or implied by these forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such FLS include, without limitation: the risk factors discussed in our most recent Annual Report on Form 10-K; the timing of new home construction and other development in the areas where we may sell our water, which in turn may be impacted by credit availability; population growth; employment rates; general economic conditions; the market price of water; changes in customer consumption patterns; changes in applicable statutory and regulatory requirements; changes in governmental policies and procedures; uncertainties in the estimation of water available under decrees; uncertainties in the estimation of costs of delivery of water and treatment of wastewater; uncertainties in the estimation of the service life of our systems; uncertainties in the estimation of costs of construction projects; uncertainties in the amount and timing of reimbursable public improvement payments: uncertainty in the single family home rental market and our ability to rent homes in a timely manner or at the amount we project; the strength and financial resources of our competitors; our ability to find and retain skilled personnel; climatic and weather conditions, including flood, droughts and freezing conditions; labor relations; availability and cost of labor, material and equipment; delays in anticipated permit and construction dates; environmental risks and regulations; our ability to raise capital; our ability to negotiate contracts with new customers; and uncertainties in water court rulings; and other factors discussed from time to time in our press releases, public statements and documents filed or furnished with the SEC. Forward-Looking Statements 2 • • • • • • • ■ • • |

| 3 Leadership Team MARK W. HARDING President, CEO, and Director Mark is an exceptional leader who has significantly shaped Pure Cycle's success. Under his 35-year tenure, the company has successfully acquired over $130 million in water and land interests. His vision and strategic acumen have been instrumental in the company's growth and impact. MARC SPEZIALY VP, CFO, Principal Accounting Officer, Principal Financial Officer Marc brings over 20 years of financial expertise. He manages our financial operations and single-family rentals. Marc obtained his bachelor's degree in Accounting and Finance from the University of San Francisco and is a licensed Certified Public Accountant. RACHELLE BEAUDRY Head of Marketing SCOTT LEHMAN Vice President, Engineering Scott brings four decades of experience as a Professional Engineer (PE) to the role. His expertise encompasses planning, design, construction, and operation of water and wastewater systems. With educational foundations from the University of Colorado and Stanford University, he plays a pivotal role in shaping our strategies and operations in this vital sector. DIRK LASHNITS Vice President, Land Development Dirk is a seasoned leader with a Civil Engineering background and over two decades of local land development experience. He skillfully guides land development, entitlements, and construction, playing a vital role in advancing corporate objectives, risk management, and project success. |

| 4 Board of Directors Mark W. Harding Patrick J. Beirne Susan Heitmann Jeffrey G. Sheets Wanda J. Abel Daniel R. Kozlowski Fredrick A. Fendel III President and CEO Chair of the Board Director and Chair of the Audit Committee Director Director Director and Chair of the Compensation Committee Director and Chair of the Nominating and Governance Committee |

| LS FINANCIALS PURE CYCLE CORPORATION 5 1,000 QJ --- Q3 |

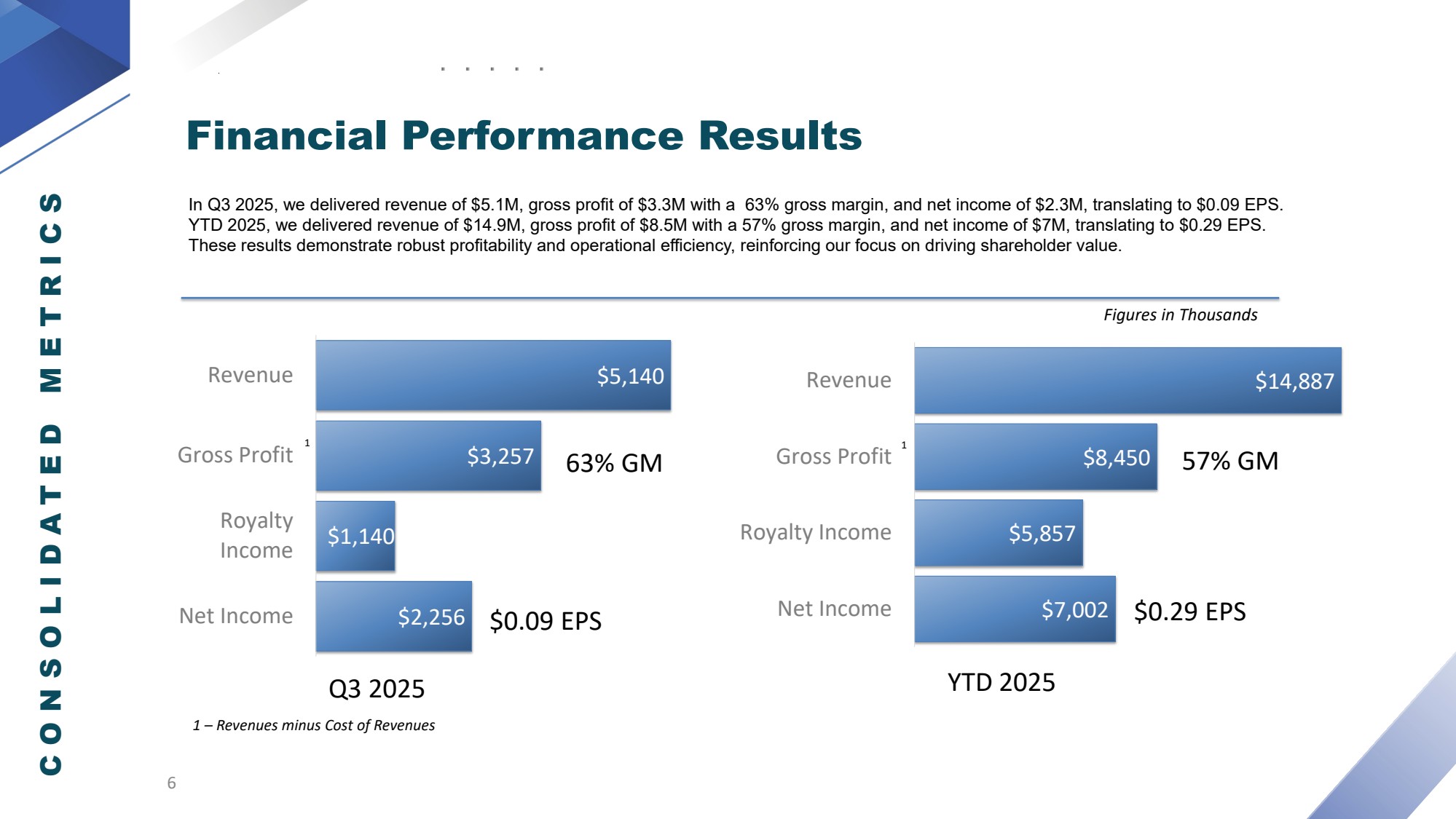

| Financial Performance Results CONSOLIDATED METRICS In Q3 2025, we delivered revenue of $5.1M, gross profit of $3.3M with a 63% gross margin, and net income of $2.3M, translating to $0.09 EPS. YTD 2025, we delivered revenue of $14.9M, gross profit of $8.5M with a 57% gross margin, and net income of $7M, translating to $0.29 EPS. These results demonstrate robust profitability and operational efficiency, reinforcing our focus on driving shareholder value. 6 $2,256 $1,140 $3,257 $5,140 Net Income Royalty Income Gross Profit Revenue $0.09 EPS 1 63% GM Figures in Thousands 1 – Revenues minus Cost of Revenues Q3 2025 $7,002 $5,857 $8,450 $14,887 Net Income Royalty Income Gross Profit Revenue $0.29 EPS 1 57% GM YTD 2025 ■ ■ ■ ■ ■ |

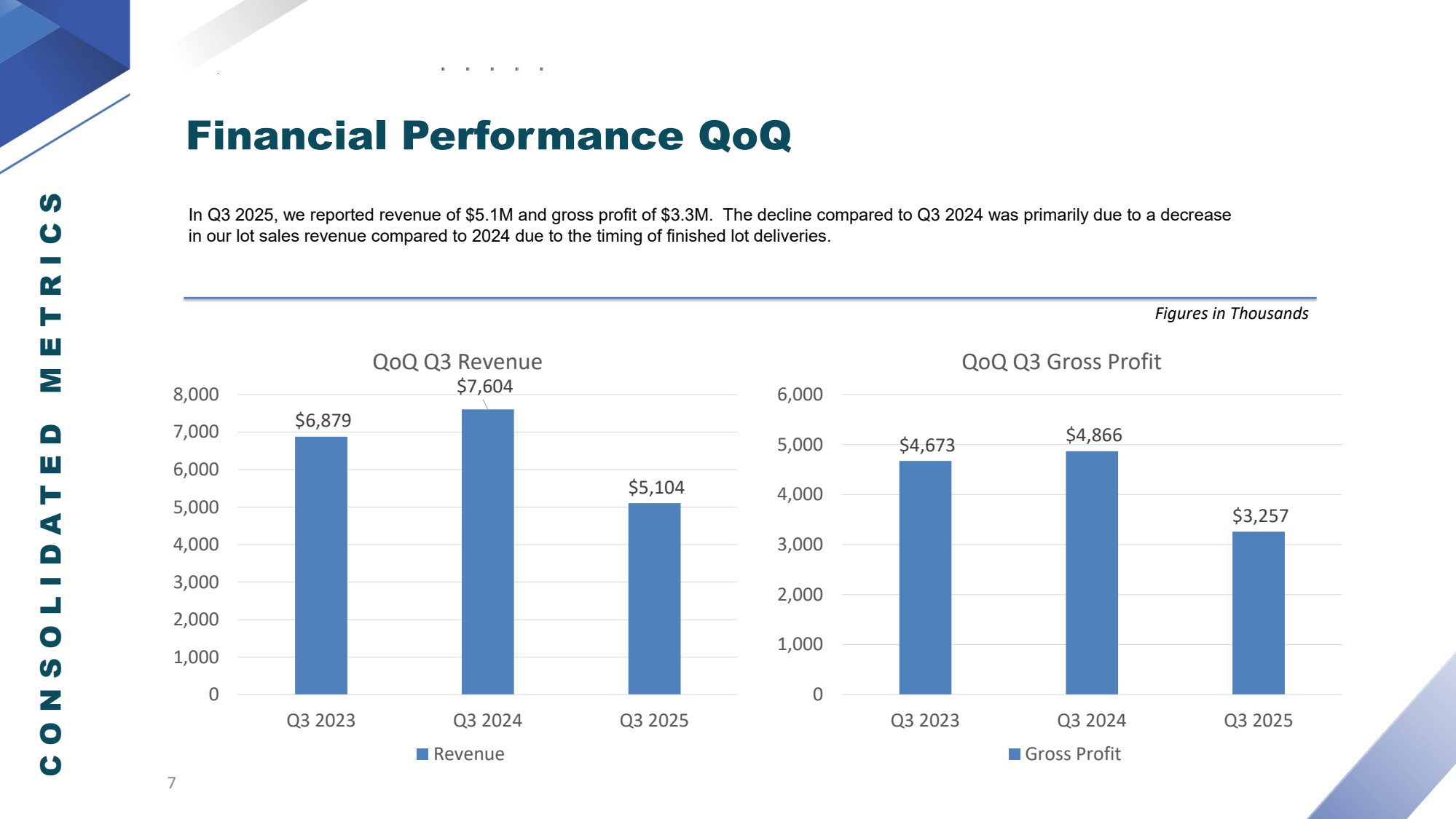

| Financial Performance QoQ In Q3 2025, we reported revenue of $5.1M and gross profit of $3.3M. The decline compared to Q3 2024 was primarily due to a decrease in our lot sales revenue compared to 2024 due to the timing of finished lot deliveries. 7 $6,879 $7,604 $5,104 0 1,000 2,000 3,000 4,000 5,000 6,000 7,000 8,000 Q3 2023 Q3 2024 Q3 2025 QoQ Q3 Revenue Revenue $4,673 $4,866 $3,257 0 1,000 2,000 3,000 4,000 5,000 6,000 Q3 2023 Q3 2024 Q3 2025 QoQ Q3 Gross Profit Gross Profit Figures in Thousands CONSOLIDATED METRICS ■ ■ ■ ■ ■ ■ ■ |

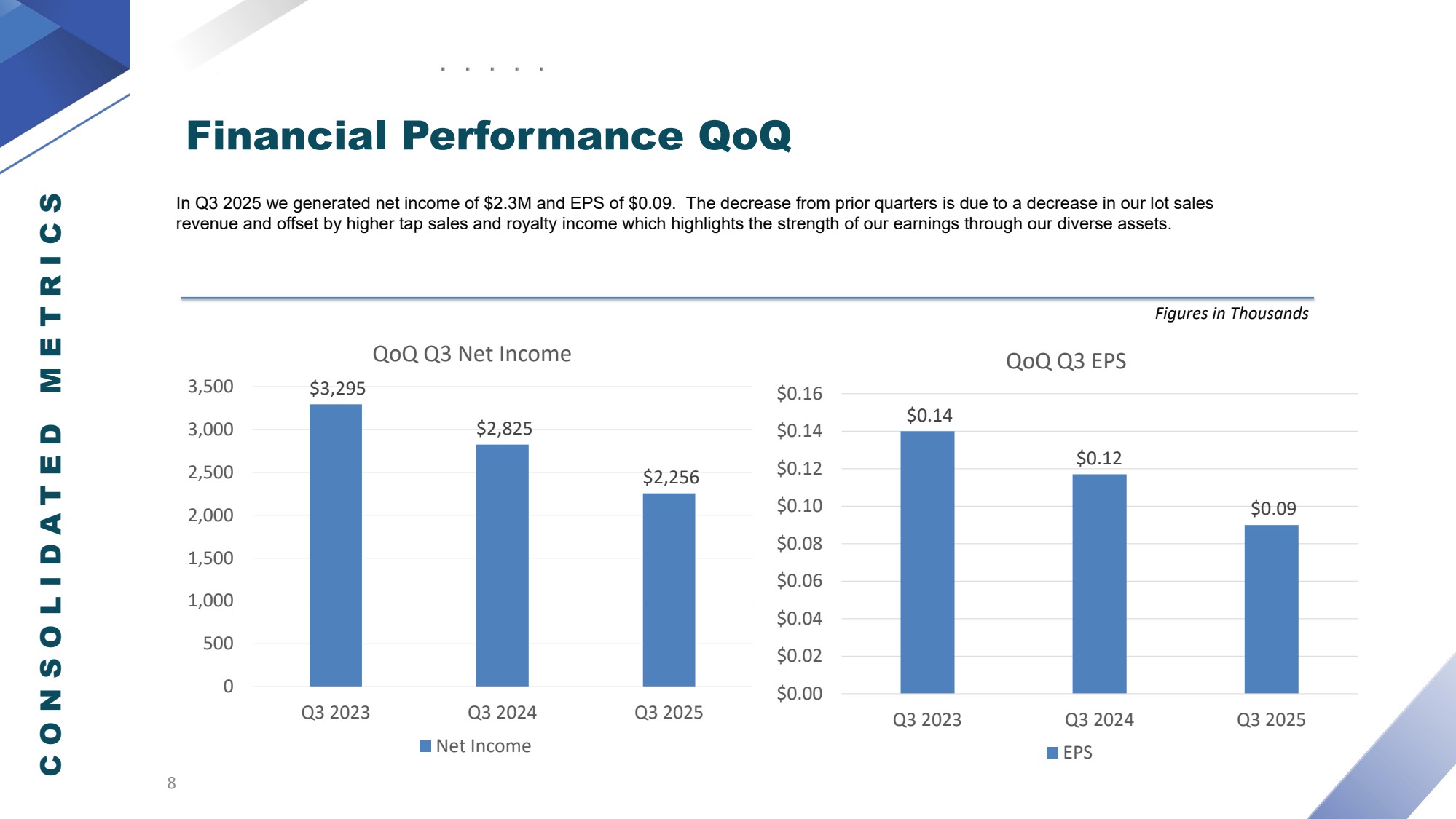

| $0.14 $0.12 $0.09 $0.00 $0.02 $0.04 $0.06 $0.08 $0.10 $0.12 $0.14 $0.16 Q3 2023 Q3 2024 Q3 2025 QoQ Q3 EPS EPS $3,295 $2,825 $2,256 0 500 1,000 1,500 2,000 2,500 3,000 3,500 Q3 2023 Q3 2024 Q3 2025 QoQ Q3 Net Income Net Income In Q3 2025 we generated net income of $2.3M and EPS of $0.09. The decrease from prior quarters is due to a decrease in our lot sales revenue and offset by higher tap sales and royalty income which highlights the strength of our earnings through our diverse assets. 8 Figures in Thousands CONSOLIDATED METRICS Financial Performance QoQ ■ ■ ■ ■ ■ ■ ■ |

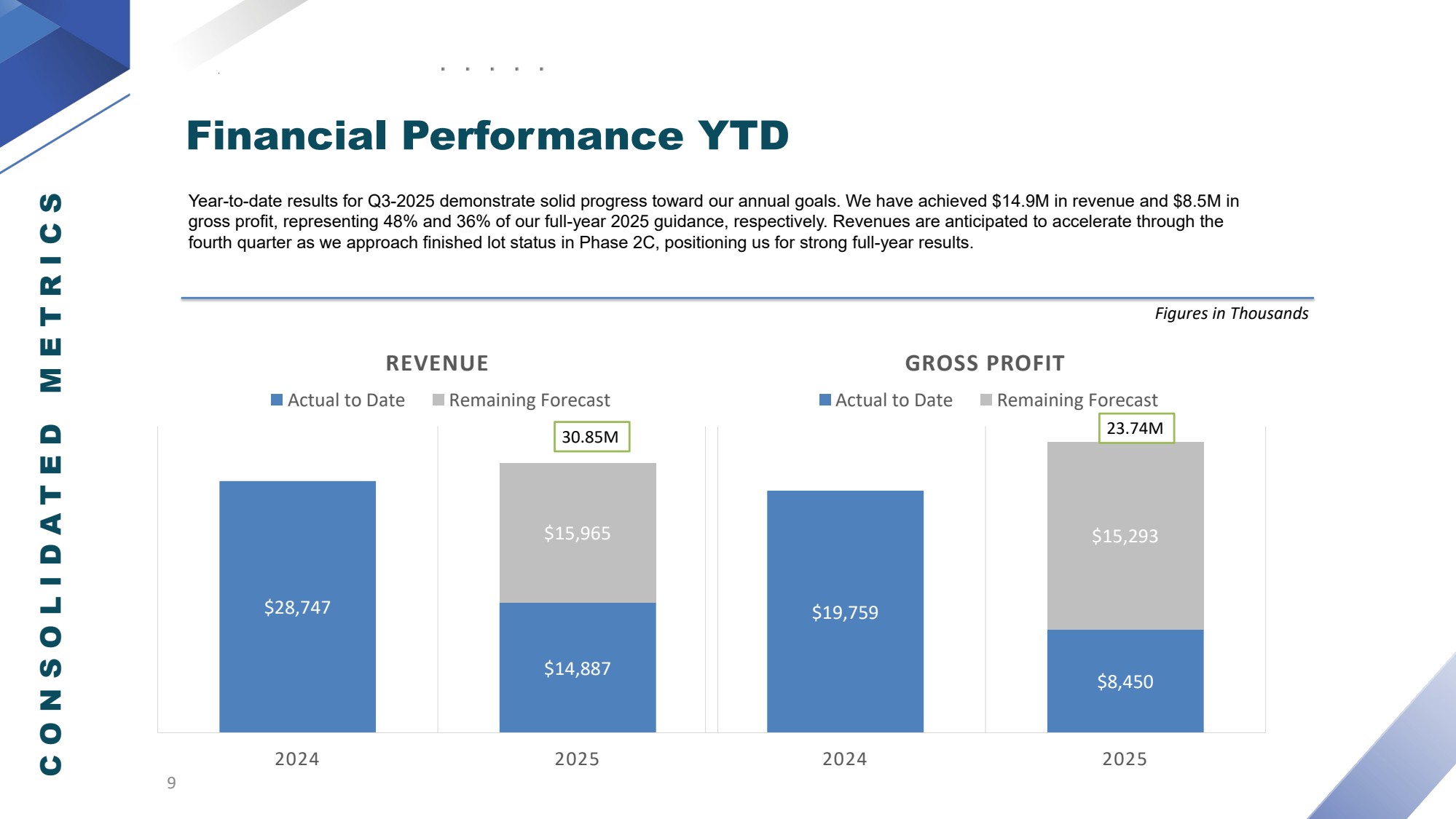

| Financial Performance YTD Year-to-date results for Q3-2025 demonstrate solid progress toward our annual goals. We have achieved $14.9M in revenue and $8.5M in gross profit, representing 48% and 36% of our full-year 2025 guidance, respectively. Revenues are anticipated to accelerate through the fourth quarter as we approach finished lot status in Phase 2C, positioning us for strong full-year results. 9 Figures in Thousands CONSOLIDATED METRICS $28,747 $14,887 $15,965 2024 2025 REVENUE Actual to Date Remaining Forecast 30.85M $19,759 $8,450 $15,293 2024 2025 GROSS PROFIT Actual to Date Remaining Forecast 23.74M ■ ■ ■ • ■ ■ ■ ■ ■ |

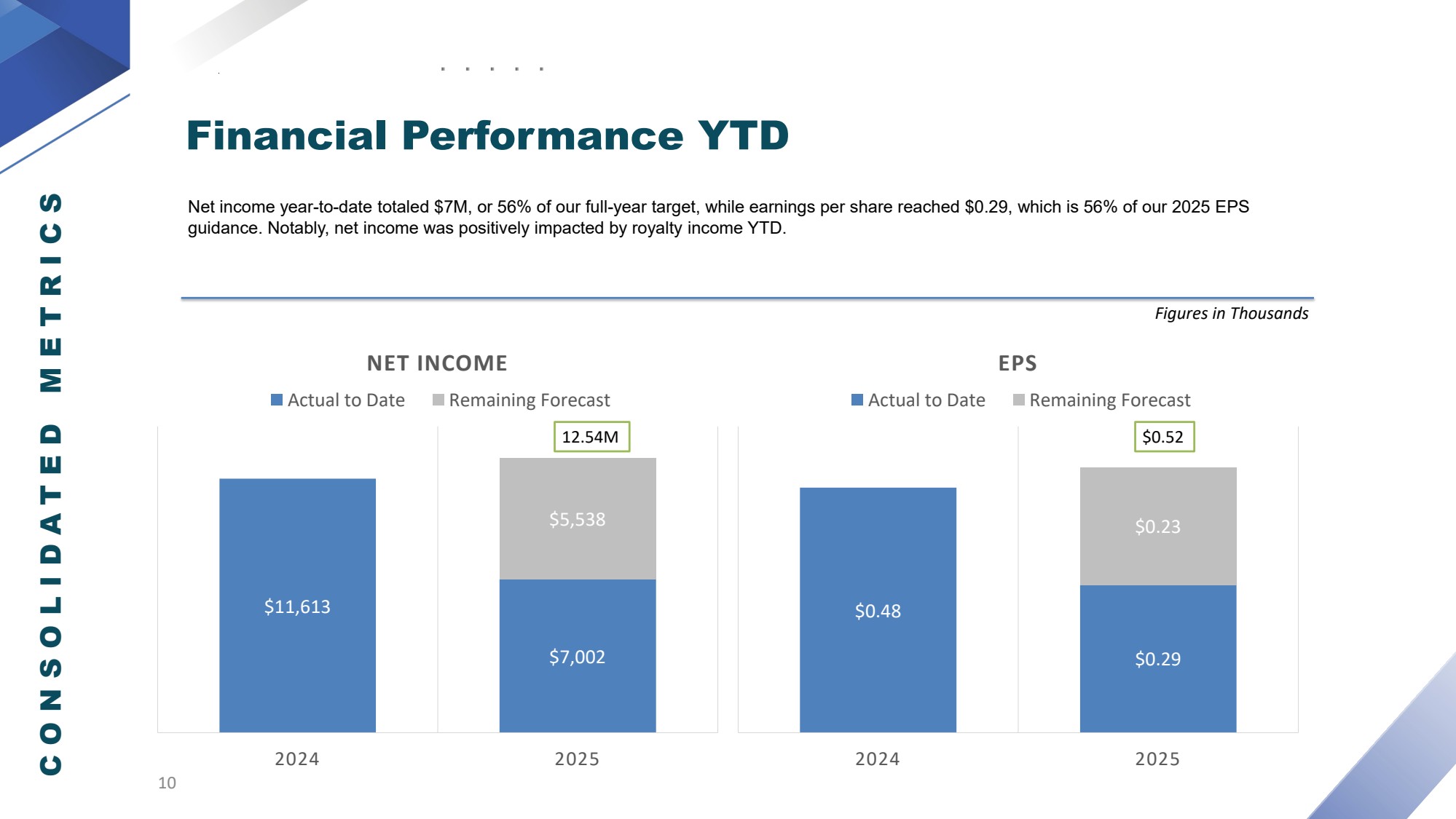

| Net income year-to-date totaled $7M, or 56% of our full-year target, while earnings per share reached $0.29, which is 56% of our 2025 EPS guidance. Notably, net income was positively impacted by royalty income YTD. 10 Figures in Thousands CONSOLIDATED METRICS Financial Performance YTD $11,613 $7,002 $5,538 2024 2025 NET INCOME Actual to Date Remaining Forecast 12.54M $0.48 $0.29 $0.23 2024 2025 EPS Actual to Date Remaining Forecast $0.52 ■ ■ ■ • ■ ■ ■ ■ ■ D |

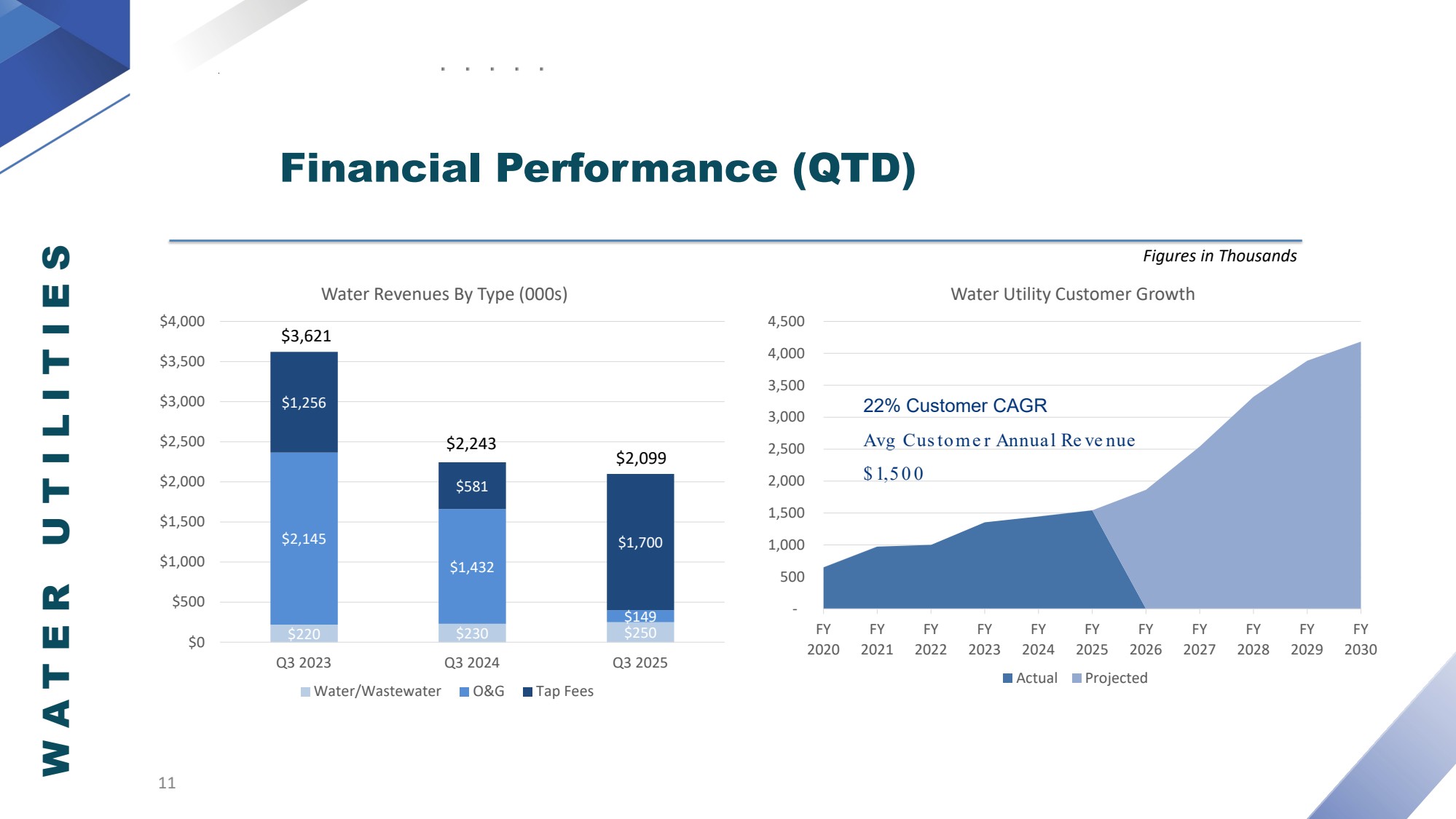

| WATER UTILITIES 22% Customer CAGR Avg Cus to me r Annual Re ve nue $ 1,5 0 0 - 500 1,000 1,500 2,000 2,500 3,000 3,500 4,000 4,500 FY 2020 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025 FY 2026 FY 2027 FY 2028 FY 2029 FY 2030 Water Utility Customer Growth Actual Projected 11 Figures in Thousands Financial Performance (QTD) $220 $230 $250 $2,145 $1,432 $149 $1,256 $581 $1,700 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 Q3 2023 Q3 2024 Q3 2025 Water Revenues By Type (000s) Water/Wastewater O&G Tap Fees $2,243 $2,099 $3,621 ■ ■ ■ ■ ■ ■ ■ ■ ■ ■ |

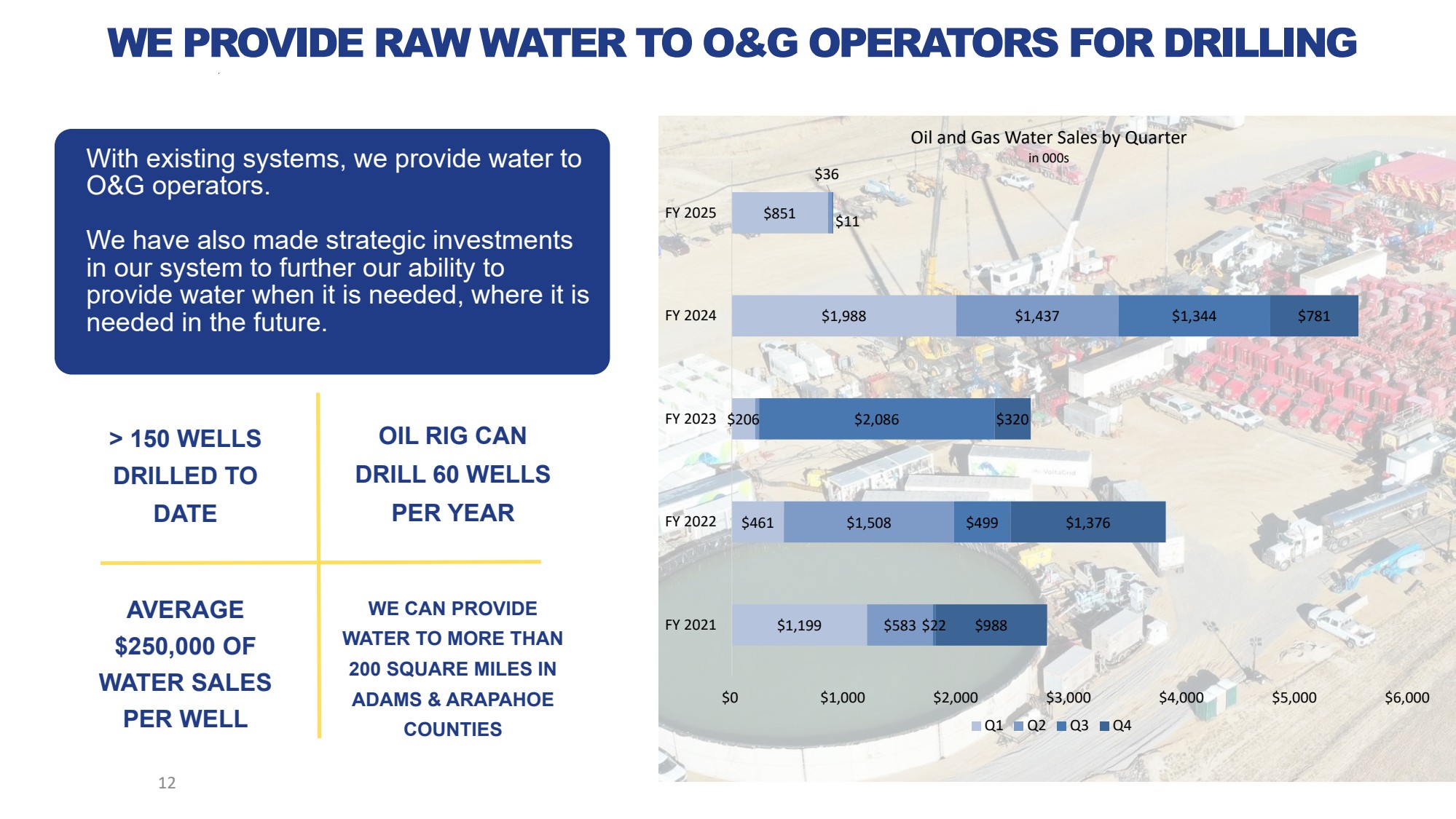

| > 150 WELLS DRILLED TO DATE AVERAGE $250,000 OF WATER SALES PER WELL OIL RIG CAN DRILL 60 WELLS PER YEAR WE CAN PROVIDE WATER TO MORE THAN 200 SQUARE MILES IN ADAMS & ARAPAHOE COUNTIES With existing systems, we provide water to O&G operators. We have also made strategic investments in our system to further our ability to provide water when it is needed, where it is needed in the future. WE PROVIDE RAW WATER TO O&G OPERATORS FOR DRILLING 12 $1,199 $461 $206 $1,988 $851 $583 $1,508 $1,437 $36 $22 $499 $2,086 $1,344 $11 $988 $1,376 $320 $781 $0 $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 FY 2021 FY 2022 FY 2023 FY 2024 FY 2025 Oil and Gas Water Sales by Quarter in 000s Q1 Q2 Q3 Q4 |

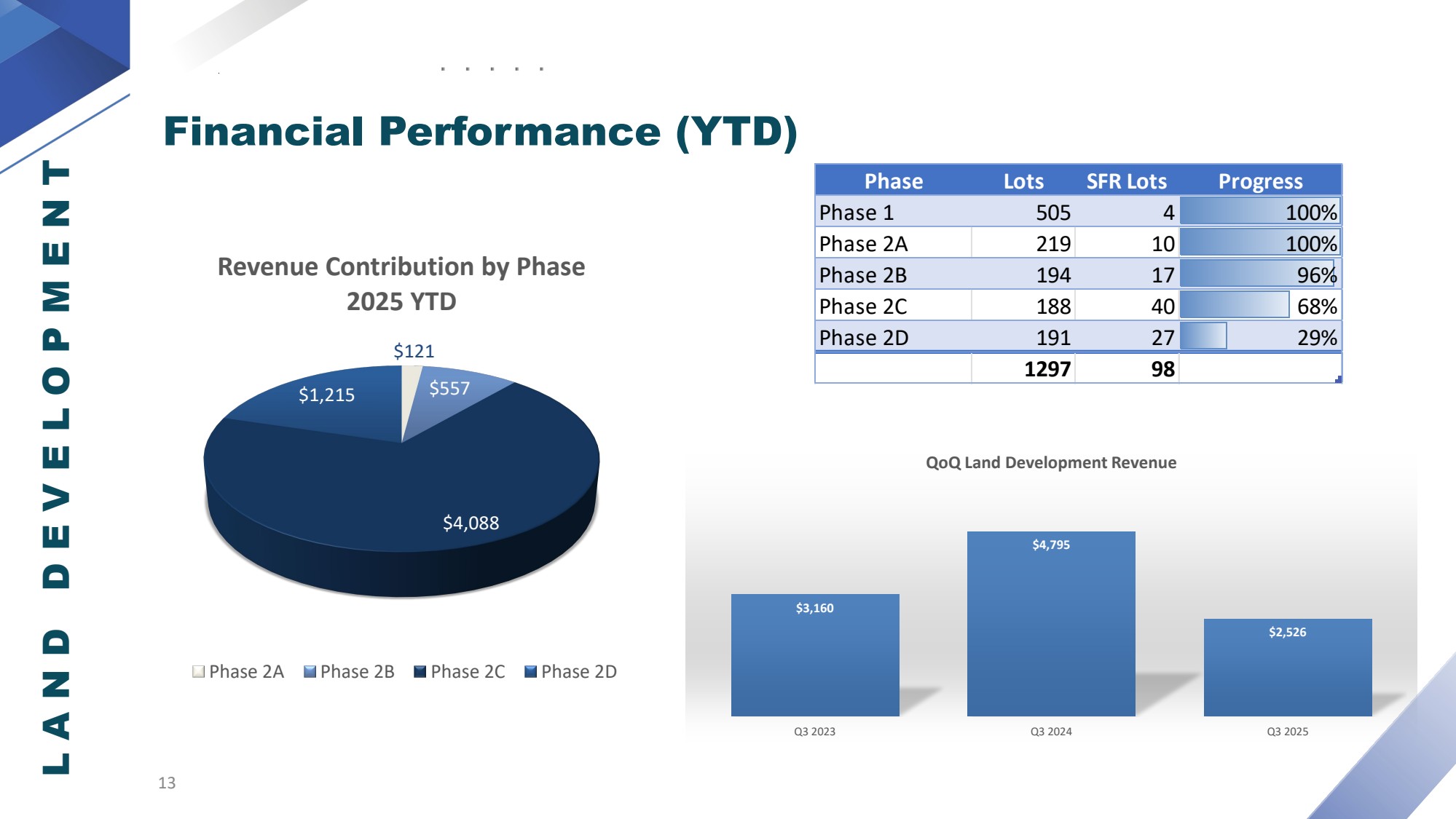

| LAND DEVELOPMENT 13 Financial Performance (YTD) $3,160 $4,795 $2,526 Q3 2023 Q3 2024 Q3 2025 QoQ Land Development Revenue $121 $557 $4,088 $1,215 Revenue Contribution by Phase 2025 YTD Phase 2A Phase 2B Phase 2C Phase 2D Phase Lots SFR Lots Progress Phase 1 505 4 100% Phase 2A 219 10 100% Phase 2B 194 17 96% Phase 2C 188 40 68% Phase 2D 191 27 29% 1297 98 ■ ■ ■ ■ ■ ■ |

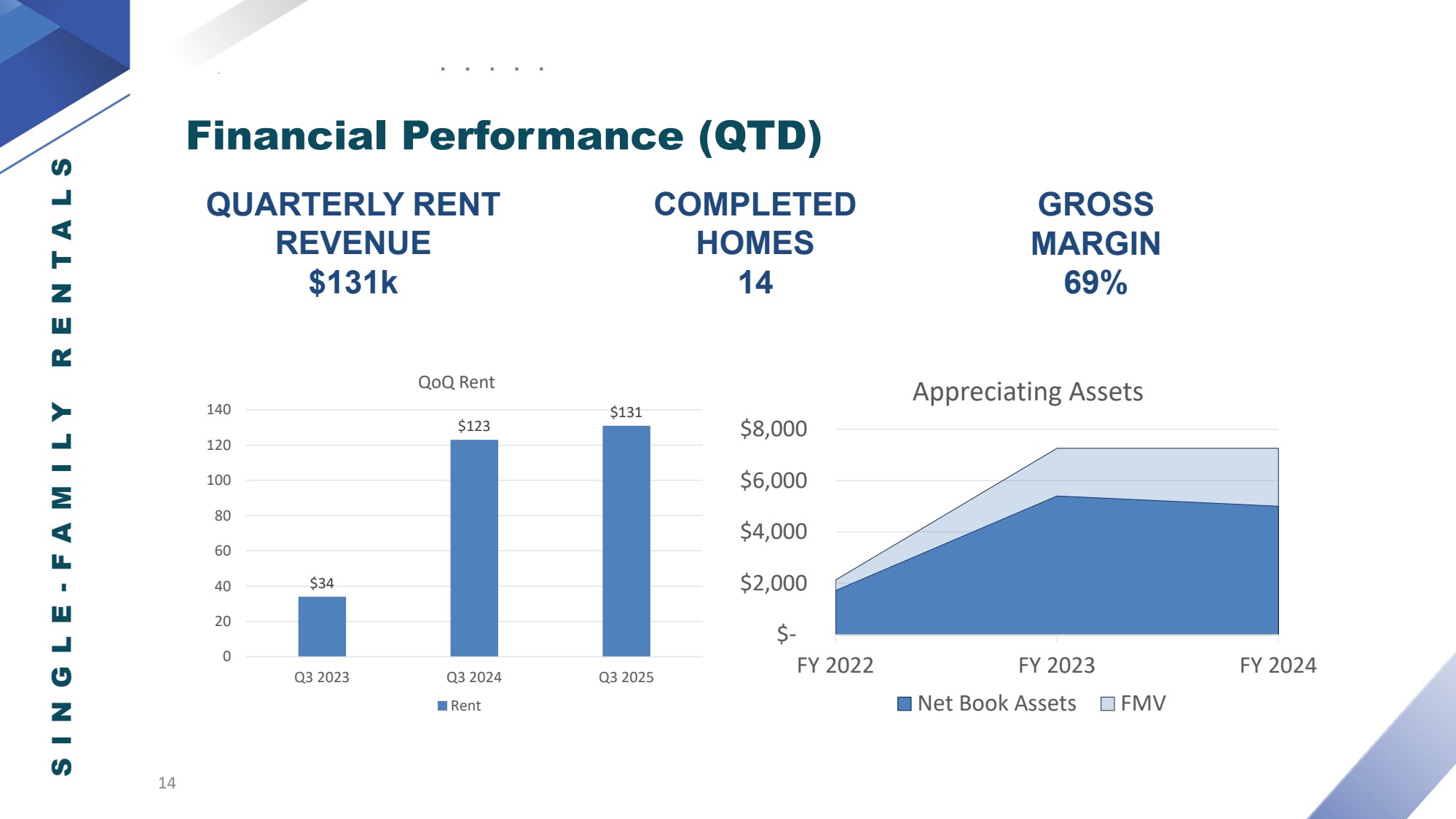

| QUARTERLY RENT REVENUE $131k COMPLETED HOMES 14 GROSS MARGIN 69% $- $2,000 $4,000 $6,000 $8,000 FY 2022 FY 2023 FY 2024 Appreciating Assets Net Book Assets FMV 14 SINGLE - FAMILY RENTALS Financial Performance (QTD) $34 $123 $131 0 20 40 60 80 100 120 140 Q3 2023 Q3 2024 Q3 2025 QoQ Rent Rent ■ ■ ■ • ■ ■ ■ □ |

| ER OVERVIEW LA 15 PURE CYCLE CORPORATION |

| Build single-family homes in the Denver metro area in neighborhoods we are developing Receive rental income in growing housing market Benefit from immediate asset appreciation and positive cash flows Provide water and wastewater service to rental properties SINGLE-FAMILY RENTALS Own highly-appreciated property in attractive and easily accessible I-70 Corridor of Denver, Colorado Developing nearly 930 acres of a full Master Planned community known as Sky Ranch Sky Ranch can have around 3,200 residential units and over 2 million square feet of retail, commercial and industrial uses (Equivalent of 1,800 residential units) Developing residential and commercial land for which we are the sole water and wastewater service provider LAND DEVELOPMENT Own over 30K acre-feet of water rights (surface and ground water) Water rights we estimate can serve up to 60,000 SFEs Denver metro land development requires developers to have water service as a condition of zoning, offering us a competitive edge Provide industrial and oil and gas customers with water Own and reuse our reclaimed water WATER & WASTEWATER WE OPERATE MULTIPLE COMPLIMENTARY SEGMENTS 16 |

| EW WATER LA 17 PURE CYCLE CORPORATION |

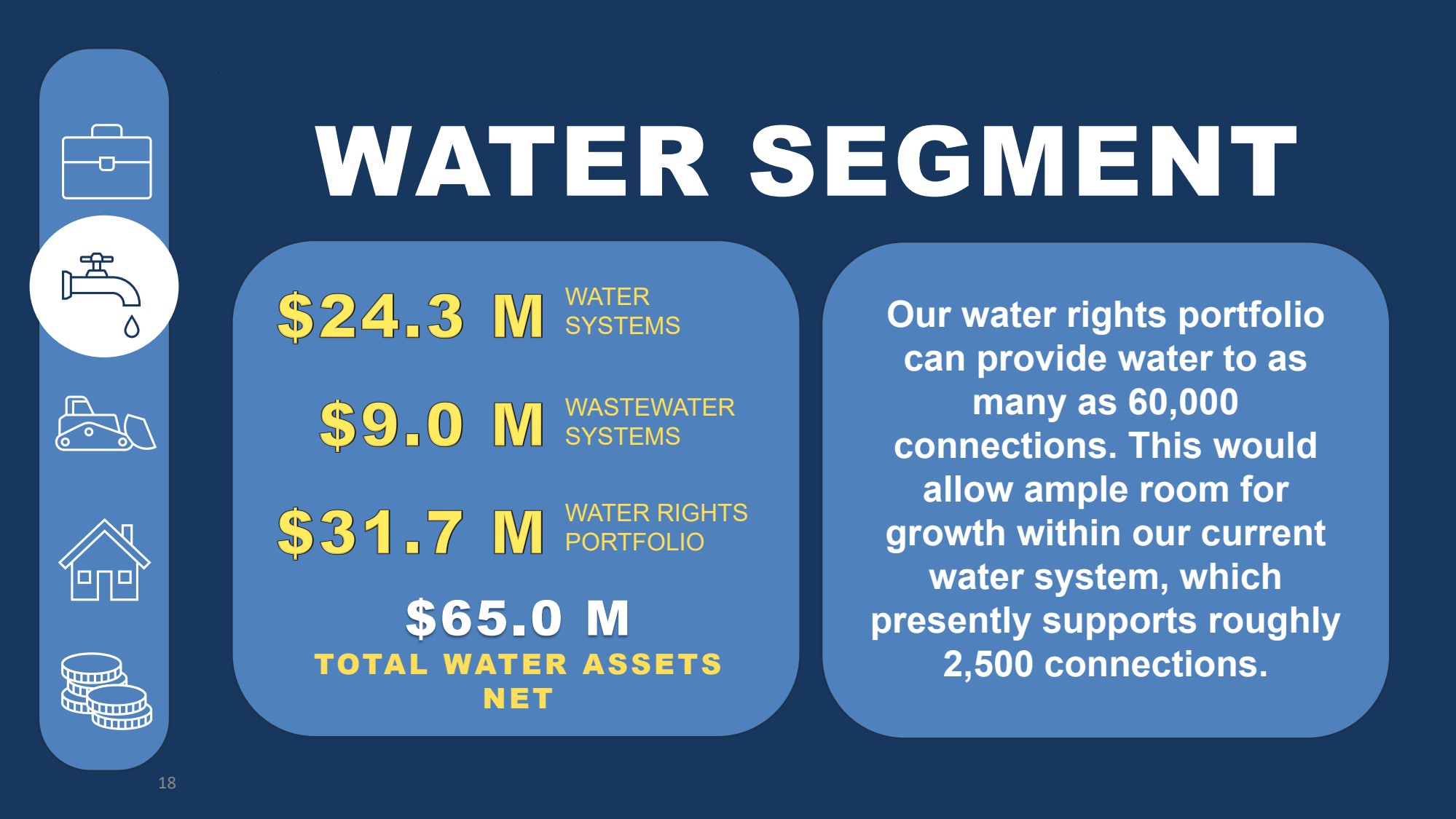

| WATER SEGMENT $65.0 M TOTAL WATER ASSETS NET Our water rights portfolio can provide water to as many as 60,000 connections. This would allow ample room for growth within our current water system, which presently supports roughly 2,500 connections. WATER SYSTEMS WASTEWATER SYSTEMS WATER RIGHTS PORTFOLIO 18 |

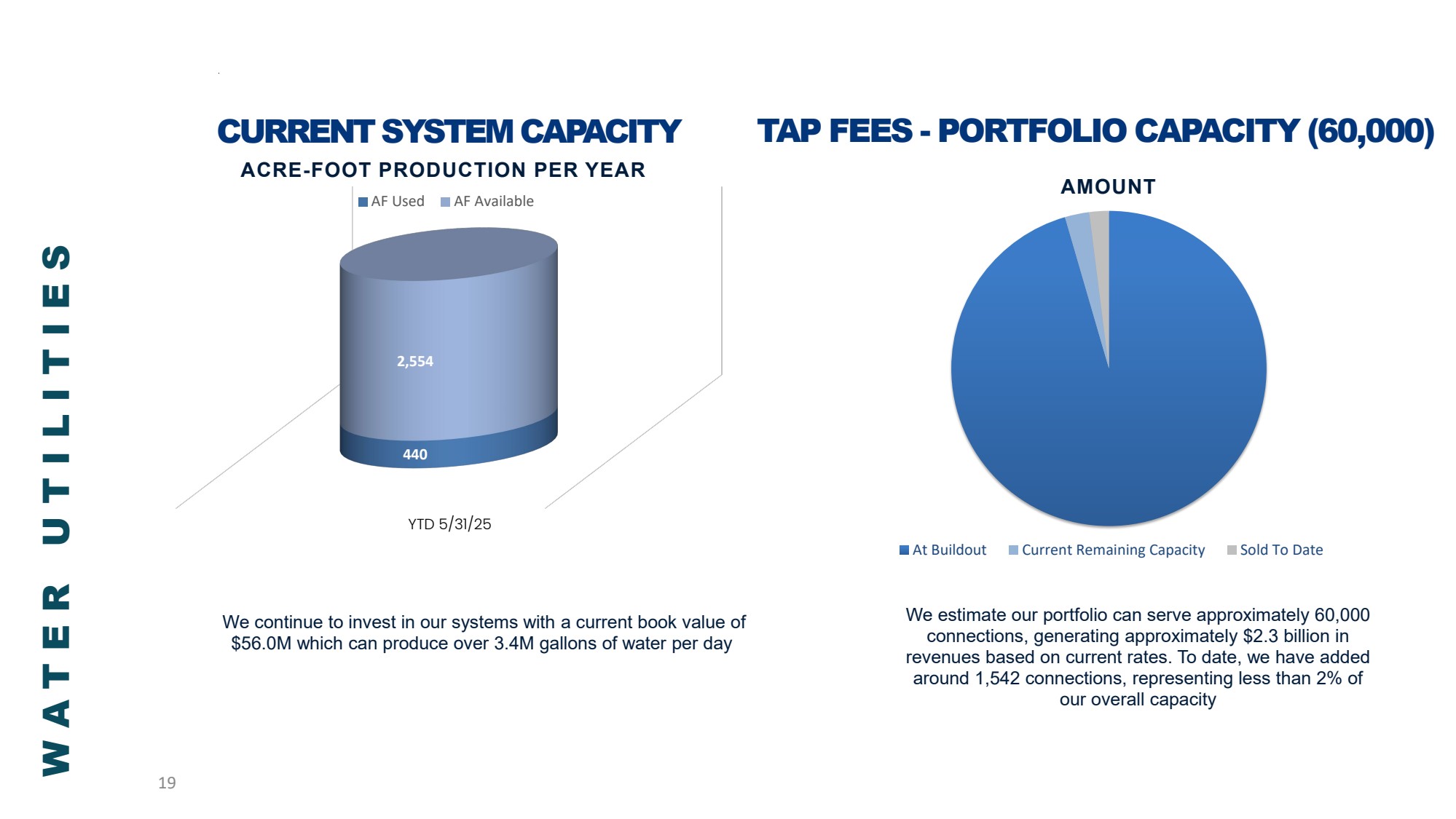

| CURRENT SYSTEM CAPACITY We continue to invest in our systems with a current book value of $56.0M which can produce over 3.4M gallons of water per day YTD 5/31/25 We estimate our portfolio can serve approximately 60,000 connections, generating approximately $2.3 billion in revenues based on current rates. To date, we have added around 1,542 connections, representing less than 2% of our overall capacity TAP FEES - PORTFOLIO CAPACITY (60,000) AMOUNT At Buildout Current Remaining Capacity Sold To Date 440 2,554 ACRE-FOOT PRODUCTION PER YEAR AF Used AF Available WATER UTILITIES 19 ■ ■ ■ ■ ■ |

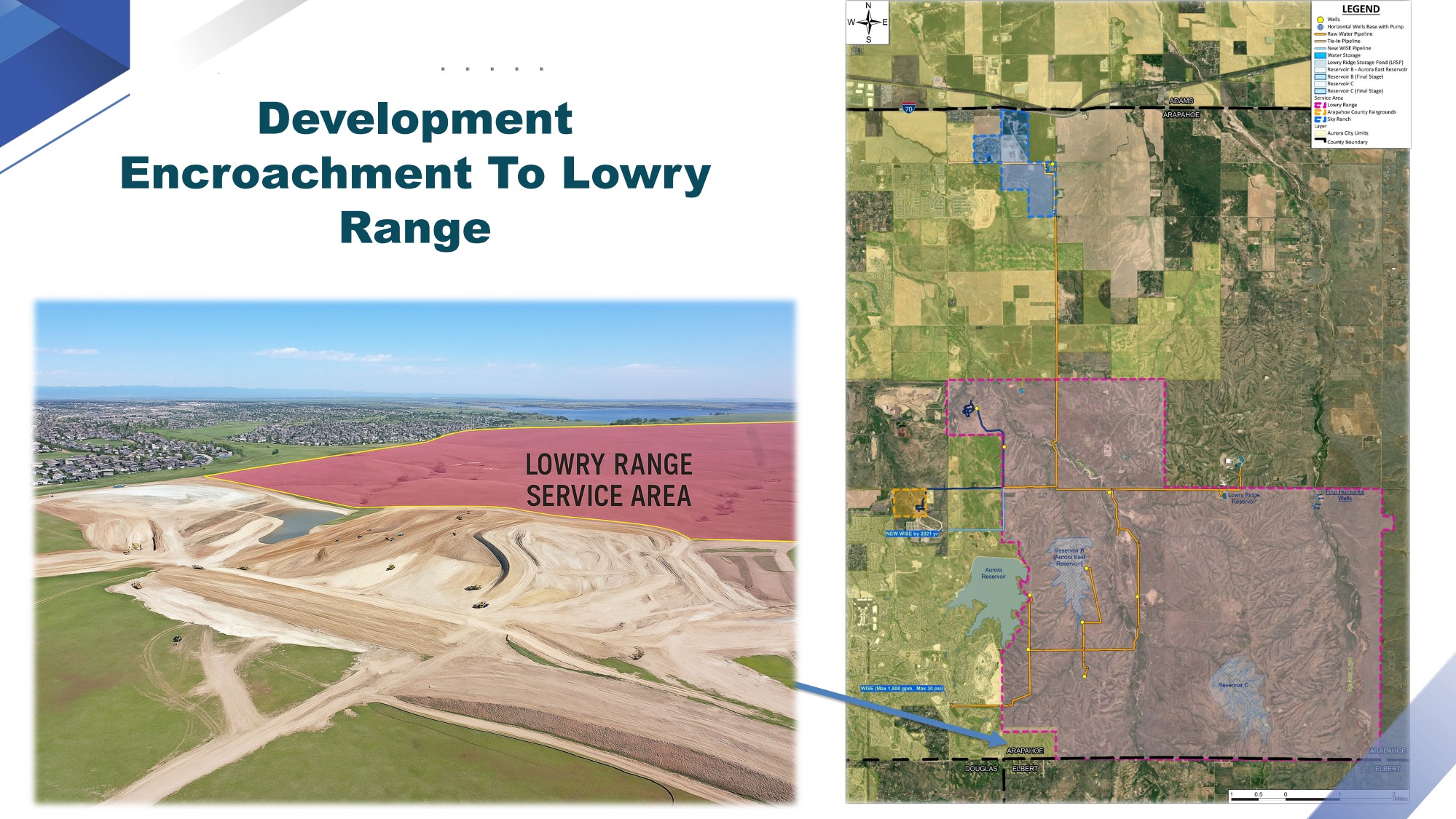

| Pg. 20 Development Encroachment To Lowry Range ■ ■ ■ ■ ■ LOWRY RANG ER LEGEND Wells Horizontal Wells Base with Pump c=;i Raw Water Pipeline c=::i Tie-In Pipeline == New WISE Pipeline Water Storage ~ Lowry Ridge Storage Pond (LRSP) [:::J Reservoir 8 - Aurora East Reservoir c::::J Reservoir B (Final Stage) [:::J Reservoir C [=1 Reservoir C (Final Stage) Service Area I:', Lowry Range Ir I Arapahoe County Fairgrounds I:'' Sky Ranch |

| R LAND DEV RE 21 PURE CYCLE CORPORATION |

| History & Strategy Pure Cycle Corporation has a strategic history of entering the land development industry, driven by its vision to enhance shareholder value and create integrated communities. Initially focused on water utility services, the company recognized the opportunity to expand its operations in the late 2010s as urban growth and housing demands increased. In 2010, Pure Cycle acquired the land that eventually became Sky Ranch and engaged in partnerships that allowed it to develop residential projects alongside its water utility offerings. This vertical integration enabled the company to provide essential services directly to the communities it was developing. Metrics of Completed Phases TOTAL LOT SALES $80m GROSS MARGIN 77% LAND DEVELOPMENT 22 ■ ■ ■ ■ ■ ■ ■ ■ ■ • |

| 2A Land development is substantially complete. Out of 229 homes, 229 are finished and occupied. PHASE 2A 229 Lots 2B Land development is substantially complete. Out of 211 homes, 115 are finished and sold. 2C Paving nearly complete Land development is scheduled to be completed by the end of fiscal year 2025 for 228 lots. 2D Grading complete, utility work underway, 20 priority lots scheduled for completion 10/30/25 Balance 8/31/26. LAND DEVELOPMENT 23 PHASE 2B 211 Lots PHASE 2C 228 Lots PHASE 2D 218 Lots • • • • • • • • • • |

| Pg. 24 GROUNDBREAKING ON HIGH SCHOOL |

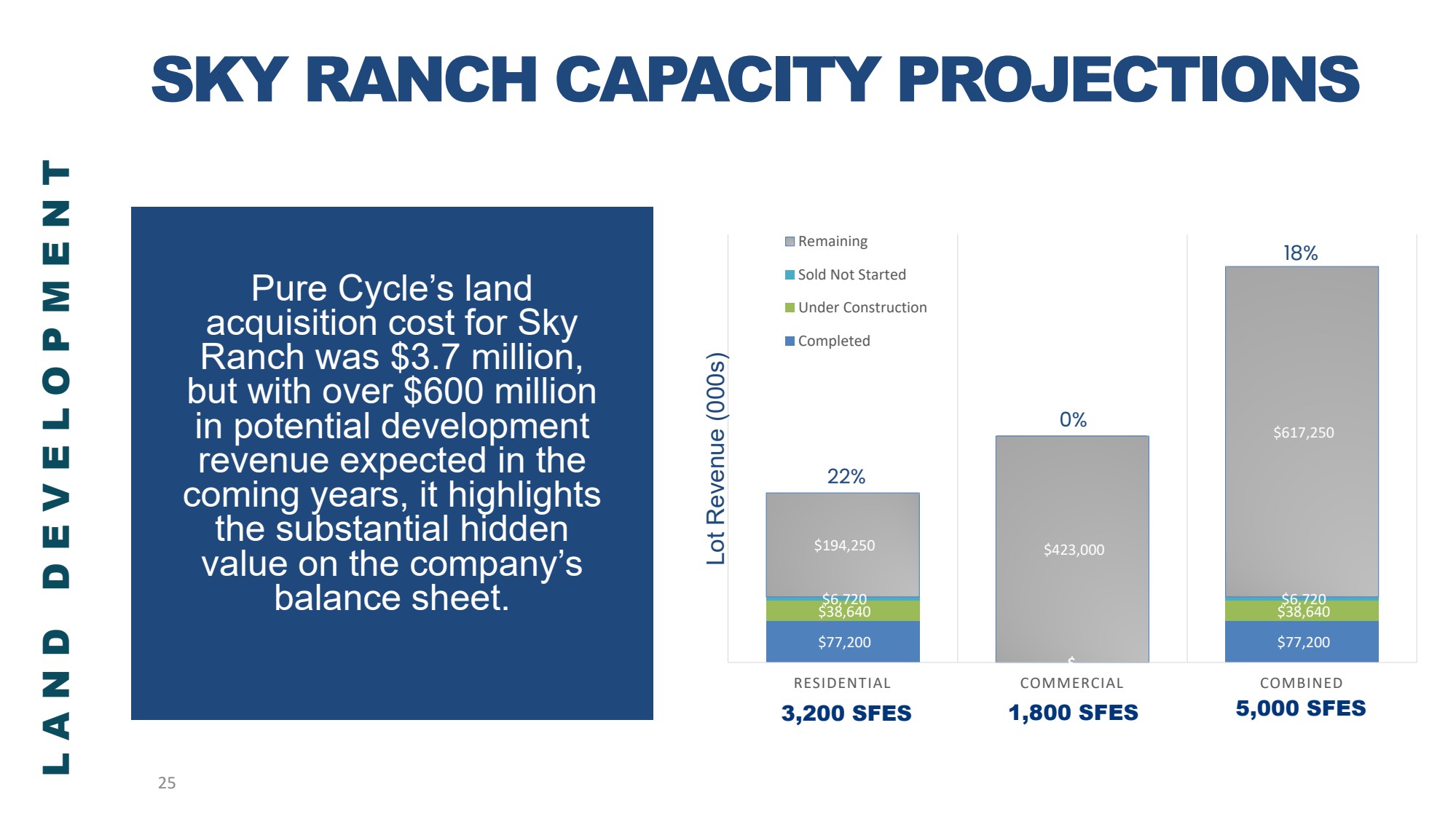

| $77,200 $- $77,200 $38,640 $38,640 $6,720 $6,720 $194,250 $423,000 $617,250 RESIDENTIAL COMMERCIAL COMBINED Remaining Sold Not Started Under Construction Completed SKY RANCH CAPACITY PROJECTIONS Lot Revenue (000s) 3,200 SFES 1,800 SFES 5,000 SFES Pure Cycle’s land acquisition cost for Sky Ranch was $3.7 million, but with over $600 million in potential development revenue expected in the coming years, it highlights the substantial hidden value on the company’s balance sheet. 22% 0% 18% LAND DEVELOPMENT 25 ■ ■ ■ |

| EV RENTALS FIN 26 PURE CYCLE CORPORATION |

| OVERVIEW OF OPERATIONS Maximizing Land Development Opportunities: By developing single-family homes for rent within our master planned community, the company can enhance the value of its landholdings and generate consistent income. Recurring Revenue: SFR properties provide a steady, recurring revenue stream. This aligns with our strategy to balance the Company’s revenue mix. Leverage Market Demand: The SFR market has been booming, driven by increased demand for rental housing from families who prefer single-family homes over apartments but may not be ready or able to purchase a home. This demand is especially strong in suburban and near-urban areas, where the Company has land. Higher Return on Investment: Developing rental properties on our land potentially offers higher returns than simply selling lots or developing for sale. This allows the Company to capitalize on both land appreciation and rental income. Pure Cycle Corporation entered the single-family rental (SFR) market as a strategic move to diversify and expand its revenue streams. As a company originally focused on water rights and infrastructure development, Pure Cycle realized the potential in the rapidly growing demand for rental properties, particularly single-family homes. 2 1 3 4 27 SINGLE - FAMILY RENTALS |

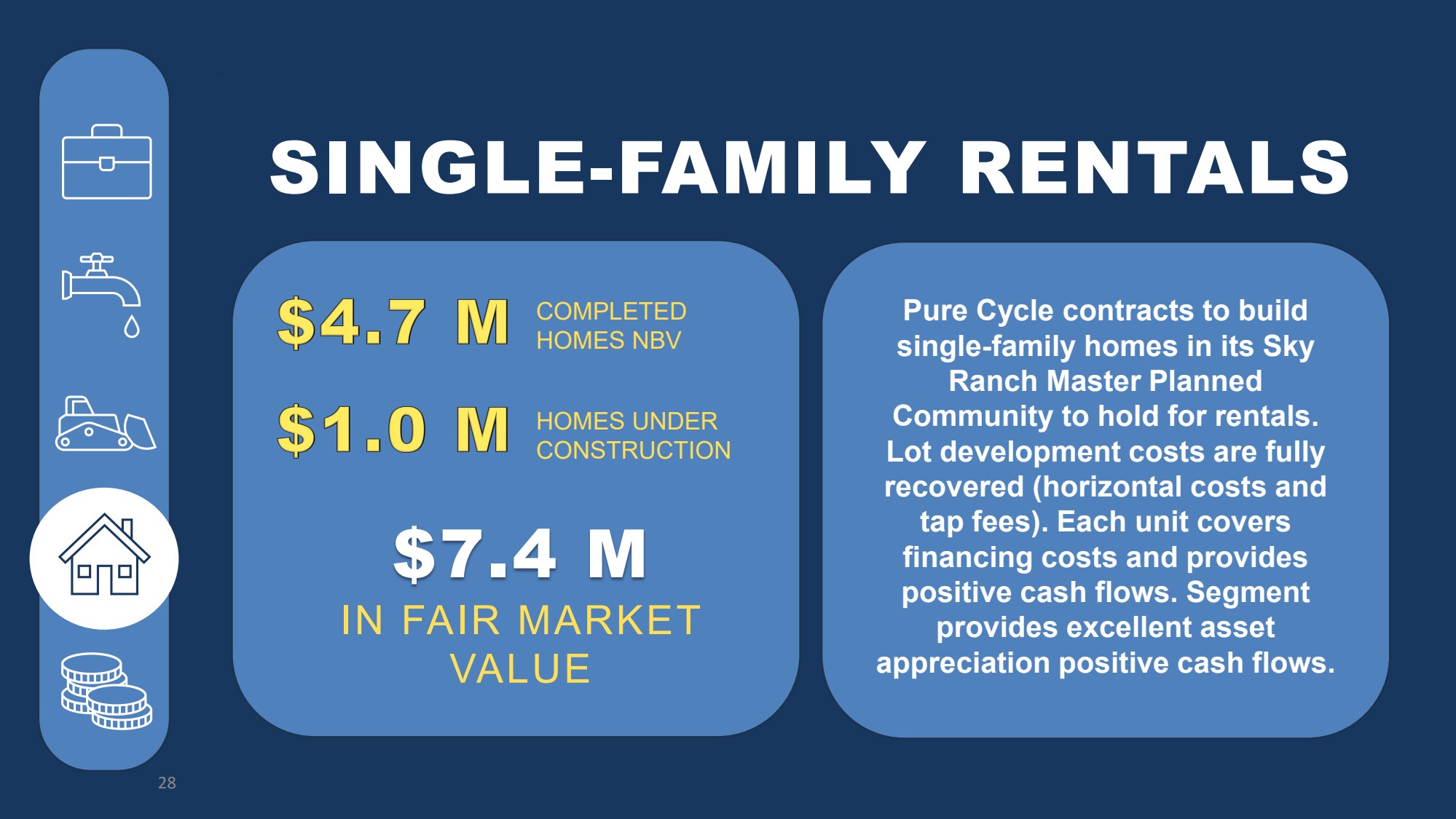

| SINGLE-FAMILY RENTALS Pure Cycle contracts to build single-family homes in its Sky Ranch Master Planned Community to hold for rentals. Lot development costs are fully recovered (horizontal costs and tap fees). Each unit covers financing costs and provides positive cash flows. Segment provides excellent asset appreciation positive cash flows. $7.4 M IN FAIR MARKET VALUE COMPLETED HOMES NBV HOMES UNDER CONSTRUCTION 28 |

| 29 Cumulative Metrics 4 14 31 71 4 10 17 40 27 Phase 1 Phase 2A Phase 2B Phase 2C Phase 2D Added in Phase Prior Phases 14 Homes $420K Rent/Yr $5.3M Assets $7.4M FMV 31 Homes $930K Rent/Yr $10.9M Assets $16.3M FMV 71 Homes $2.1M Rent/Yr $24.9M Assets $37.3M FMV 4 Homes $120K Rent/Yr $1.4M Assets $2.1M FMV 98 Homes $3M Rent/Yr $35M Assets $52.5M FMV SFR Portfolio Sky Ranch Phase 1 & 2 ■ ■ • . . • • • I |

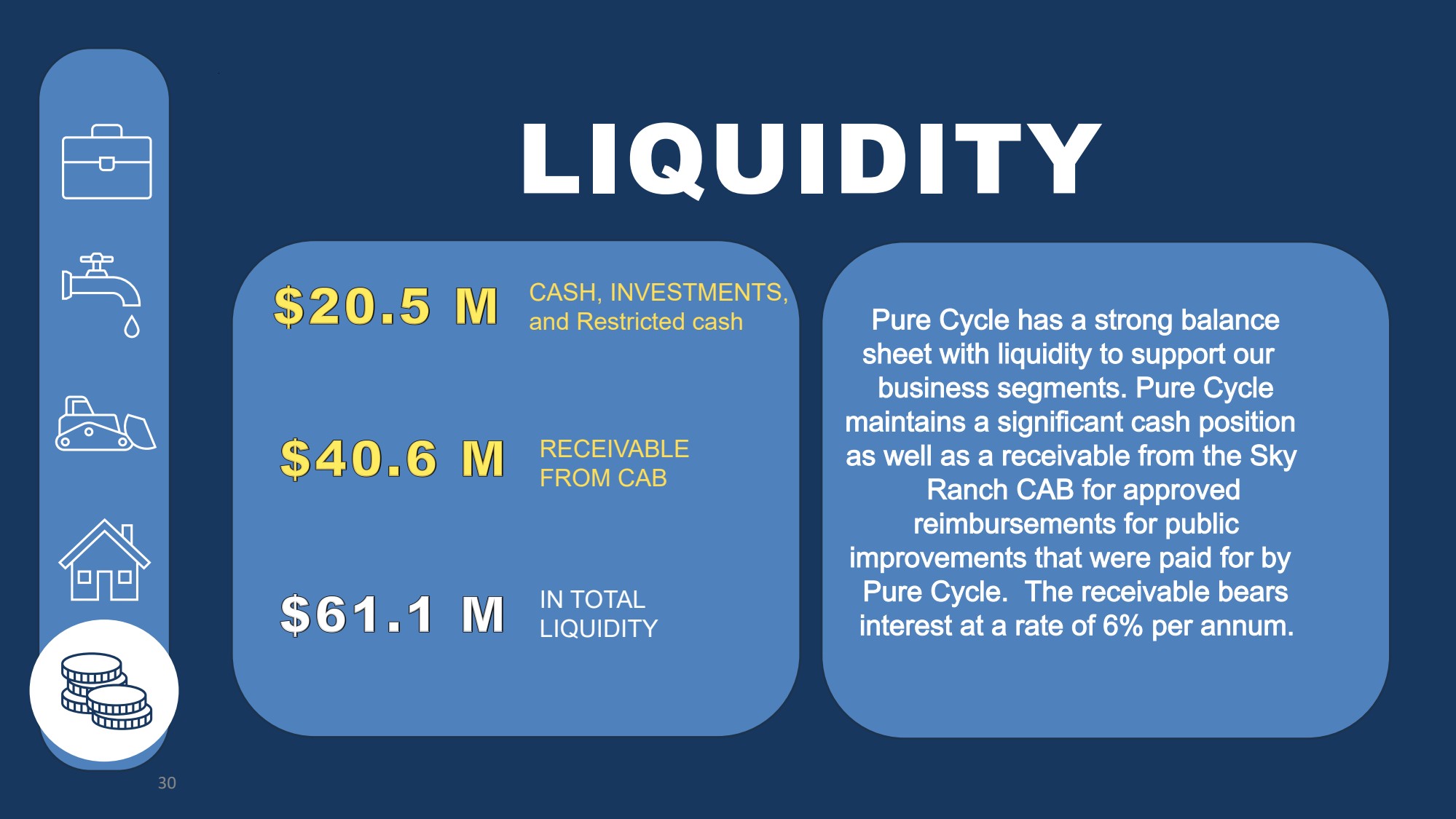

| LIQUIDITY Pure Cycle has a strong balance sheet with liquidity to support our business segments. Pure Cycle maintains a significant cash position as well as a receivable from the Sky Ranch CAB for approved reimbursements for public improvements that were paid for by Pure Cycle. The receivable bears interest at a rate of 6% per annum. CASH, INVESTMENTS, and Restricted cash RECEIVABLE FROM CAB IN TOTAL LIQUIDITY 30 |

| EW OUTLOOK LA 31 PURE CYCLE CORPORATION |

| 32 Housing Market Update New Development Completed Homes Sky Ranch HEADWINDS Weakening consumer confidence Mortgage rates Affordability Rising inventory OPPORTUNITIES Market segmentation Low inventory at entry level Phased deliveries Phase 2A Delivery 229 lots 8/31/23 Sold Homes 200 8/31/24 Phase 2B Delivery 221 lots 8/31/24 Sold Homes 115 6/30/25 Phase 2C Delivery 228 lots 8/31/25 Phase 2D Delivery 20 lots 10/30/25 Delivery 198 lots 8/31/26 Phase 2E Delivery 156 lots (Platting) TBD OverallMarket |

| COMPANY OUTLOOK SHORT TERM OUTLOOK (3-5 YEARS) • Customer growth to 2,500 accounts • Consistent tap sales over the remaining phases adding to the recurring customer base • Annual tap fee increases at 3% WATER UTILITIES • Buildout of Sky Ranch 5,000 total residential and commercial connections at Sky Ranch • Achieving greater operational efficiencies as the segment grows • Building long-term, recurring revenue streams to enhance shareholder value • System expansion will serve additional areas (Lowry Ranch, Arapahoe County parcels) LONG TERM OUTLOOK (SR Buildout) 33 ' 'r |

| • Steady lot sales over the next 5 years through the completion of Sky Ranch with opportunities to expand portfolio • Increasing lot margins as lot costs are expected to remain consistent through the remainder of Sky Ranch Development • Most valuable commercial land yet to begin monetizing which will accelerate margins LAND DEV SHORT TERM OUTLOOK (3-5 YEARS) LONG TERM OUTLOOK (SR Buildout) • Buildout/Completion of final phases of the Sky Ranch project • Expanding development into the Lowry Ranch and surrounding areas approaches Pure Cycle’s service region • Bringing online valuable commercial land at interstate interchange 34 COMPANY OUTLOOK |

| • Expansion of segment to over 100 homes in the next 5 years • Increased efficiencies as segment continues to scale • Sustained population growth, particularly in suburban areas, will drive continued demand for single-family rentals SINGLE FAMILY RENTALS SHORT TERM OUTLOOK (3-5 YEARS) LONG TERM OUTLOOK (SR Buildout) • Expansion of segment to over 200 homes growing a diversified investment portfolio to generate long-term recurring revenue • Increasing operational efficiencies as the rental segment scales • Leveraging Colorado’s strong economic growth and stable job market to support sustained rental demand and affordability 35 COMPANY OUTLOOK |

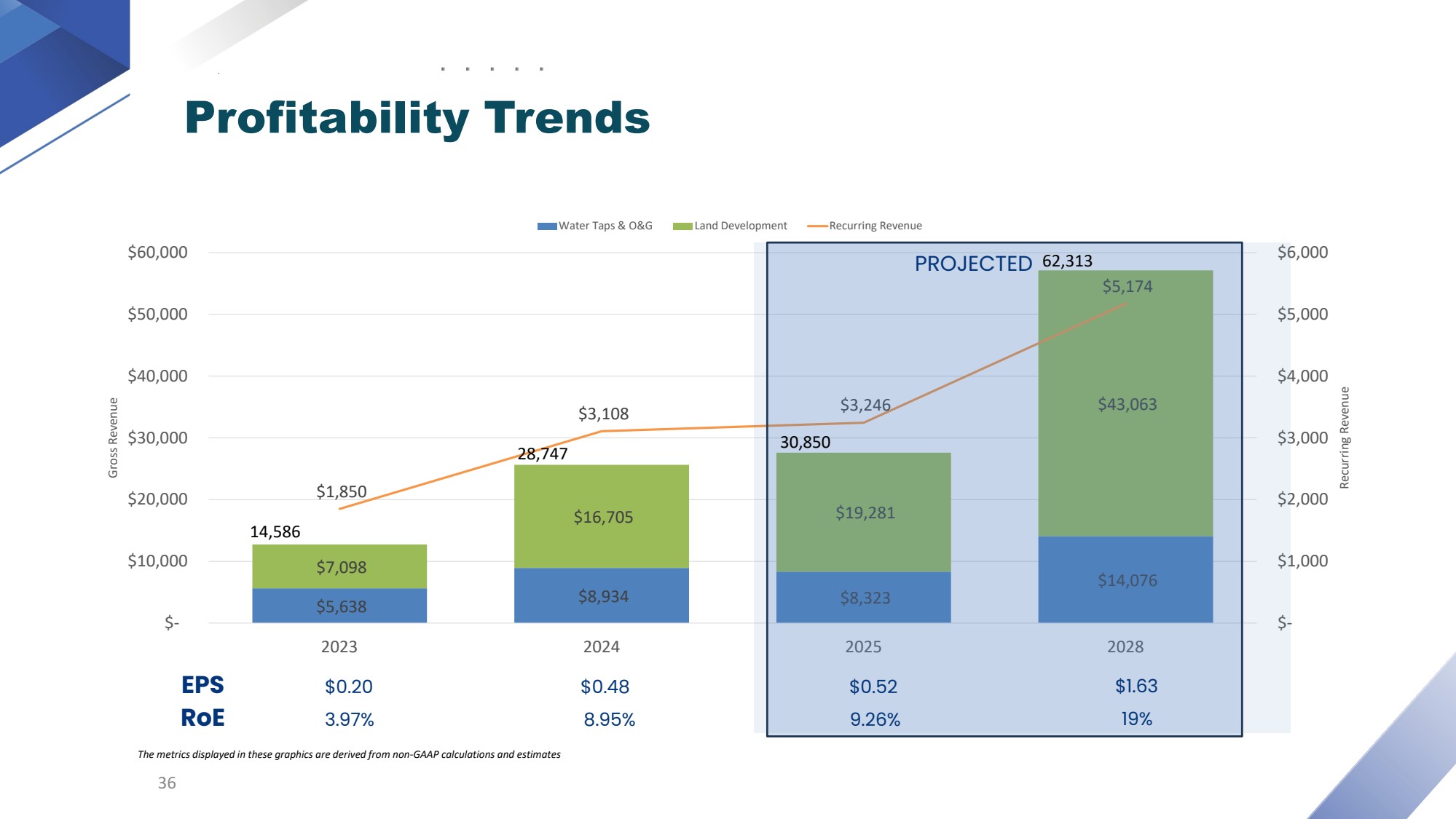

| $5,638 $8,934 $8,323 $14,076 $7,098 $16,705 $19,281 $43,063 $1,850 $3,108 $3,246 $5,174 $- $1,000 $2,000 $3,000 $4,000 $5,000 $6,000 $- $10,000 $20,000 $30,000 $40,000 $50,000 $60,000 2023 2024 2025 2028 Recurring Revenue Gross Revenue Water Taps & O&G Land Development Recurring Revenue 36 $0.20 $0.48 $0.52 $1.63 3.97% 8.95% 9.26% 19% EPS RoE Profitability Trends The metrics displayed in these graphics are derived from non-GAAP calculations and estimates PROJECTED 14,586 28,747 30,850 62,313 ■ ■ ■ ■ ■ - - |

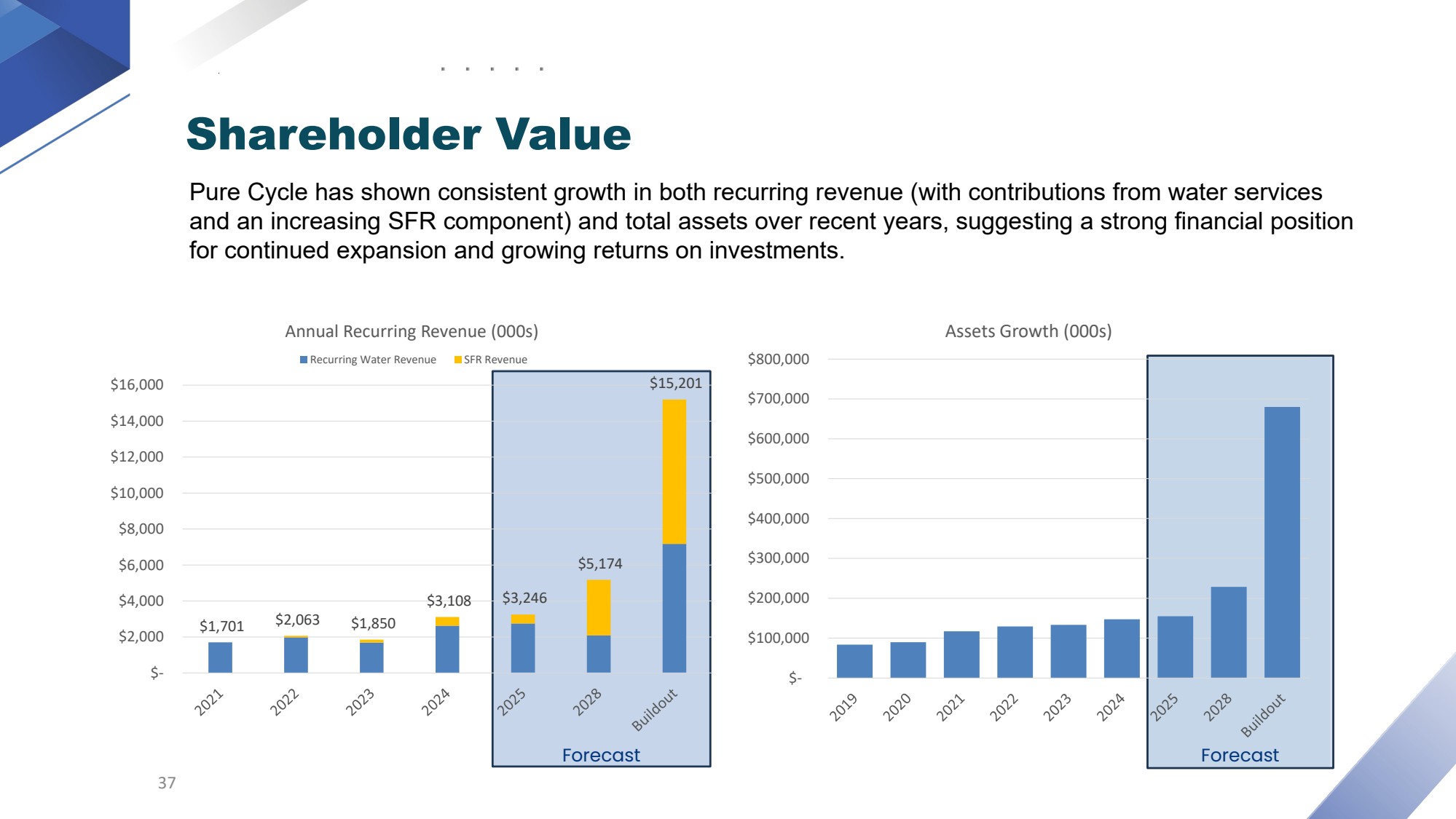

| Shareholder Value Pure Cycle has shown consistent growth in both recurring revenue (with contributions from water services and an increasing SFR component) and total assets over recent years, suggesting a strong financial position for continued expansion and growing returns on investments. 37 $- $100,000 $200,000 $300,000 $400,000 $500,000 $600,000 $700,000 $800,000 Assets Growth (000s) Forecast Forecast $1,701 $2,063 $1,850 $3,108 $3,246 $5,174 $15,201 $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 Annual Recurring Revenue (000s) Recurring Water Revenue SFR Revenue ■ ■ ■ • ■ ■ ■ |

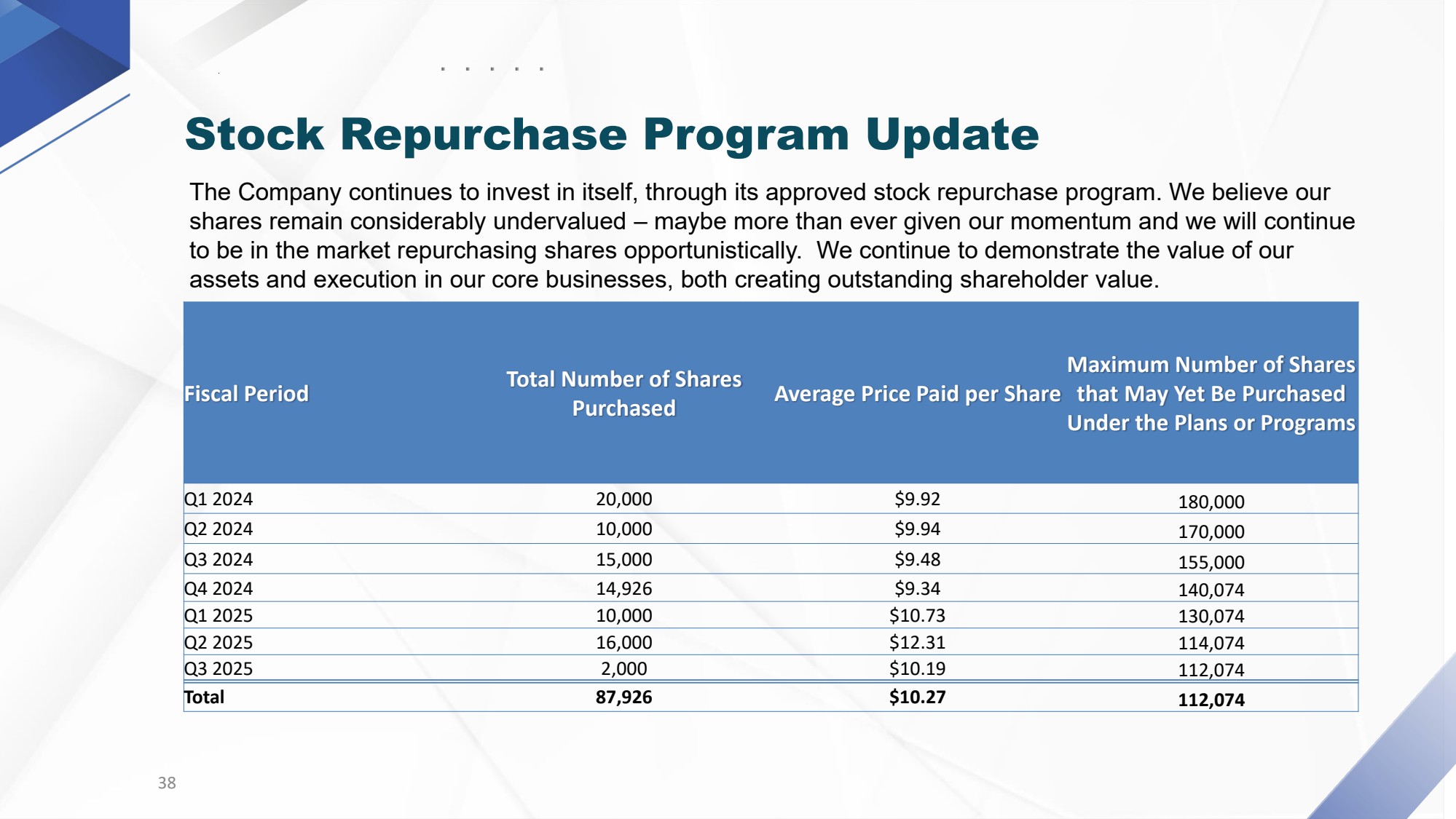

| 38 Stock Repurchase Program Update The Company continues to invest in itself, through its approved stock repurchase program. We believe our shares remain considerably undervalued – maybe more than ever given our momentum and we will continue to be in the market repurchasing shares opportunistically. We continue to demonstrate the value of our assets and execution in our core businesses, both creating outstanding shareholder value. Fiscal Period Total Number of Shares Purchased Average Price Paid per Share Maximum Number of Shares that May Yet Be Purchased Under the Plans or Programs Q1 2024 20,000 $9.92 180,000 Q2 2024 10,000 $9.94 170,000 Q3 2024 15,000 $9.48 155,000 Q4 2024 14,926 $9.34 140,074 Q1 2025 10,000 $10.73 130,074 Q2 2025 16,000 $12.31 114,074 Q3 2025 2,000 $10.19 112,074 Total 87,926 $10.27 112,074 ■ ■ ■ ■ ■ |

| Earnings Presentation Reminder Investor day is July 16 Starts at 10 am MST followed by a virtual Q&A Q&A PURE CYCLE CORPORATION www.purecyclewater.com ----- |